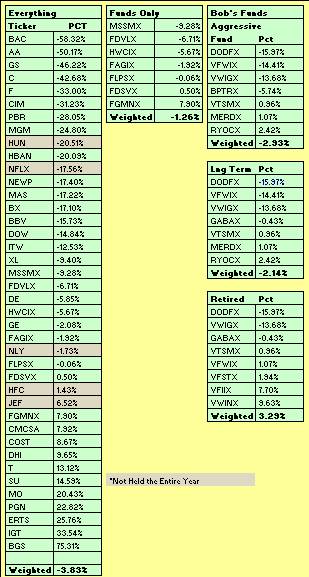

Personal

Portfolio

|

2011 was a tough year for the portfolio and I am gald it's coming to a close but it did have a few high points.

BGS

Foods once again produced outstanding returns. IGT surprised me.

The bank stocks were thoroughly depressing and I in large part

blame the anti-business bias the current administration has.

We really need to fix that next election.

|

|

The End of the Year. Finally!

.

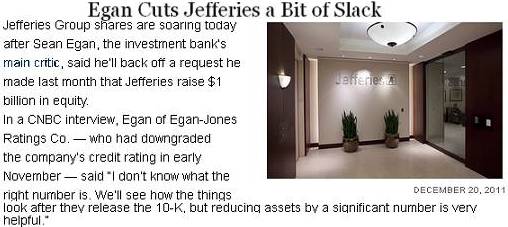

While

not an apology by any means for one of the worst analyst comments I've

seen in a while, I think this group was suitably embarrassed by

the rest of the ratings world in that they had to provide additional

commentary and while it is not positive, it is not negative.

Anyone

who bought into Jefferies during the November - December lows got a

nice Christmas present. The gains made off of this put me in an

over-weighted position so an adjustment needed to be made.

Here is a great way to make such an adjustment:

Annaly

went Ex-Dividend on the 23rd. When the stock does this, the share

price generally drops by the amount of the dividend end declared, so

what you do is buy the stock on the Ex-Dividend date. You get the

stock at a lower price and you also get the dividend if you are holding

the stock on that date. It's a win-win proposition if you think

the share price will continue to increase and the dividend is stable,

which I do.

REIT's like Annaly historically do well in

low interest rate environments and the yield has been somewhere

around 13% all year. Not a bad rate of return considering what

T-Bills and CD's are doing.

A New Addition for 2012

I decided to do some winter clean-up and sold FTR, half of CIM and all SPF - getting rid of the cheap stuff.

I

wanted to add a refiner to the mix and HollyFrontier seemed like a

screaming bargain to me. David Tepper, a hedge fund manager I

like added this to his portfolio a couple months ago, so I take that as

a decent endorsement. I bought in at 23.07.

Prognostication for 2012

More

of the same is what I think - at least for the first half of the year.

What puzzles me is the power and transmission build-out that has

been going on the last two years - and it is still going strong.

Energy capacity in the private sector is increasing.

Granted, some of the work is SCR retrofits and the like

but that's not expansion. Looking at the glass half

full, I would say that a lot of people with a lot of money are

betting on an economic growth sooner than later. Windmills and

solar panels aren't going to provide the MW''s necessary for that

kind of growth. Simple Cycle, Combined Cycle and Nuclear

power plants will.

I think that if the republicans can put

up a candidate that can actually win instead of some old dead white guy

like they did last time, we could have a very nice rebound later

on in the year.

Let us hope.

Florida Coast - Fort Lauderdale

|

|

|