| January, 2013 “The punishment of wise men who refuse to take part in the affairs of government is to live under the government of unwise men.” ~.Plato |

|

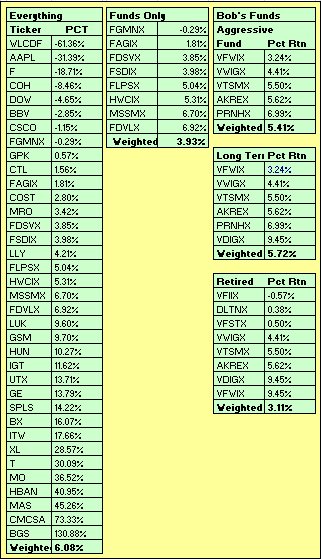

The Professional Opinion - DJ 13860.58 Bob doesn't seem as concerned about valuations and corrections as he did last month.....  Buy Recommendations None. Everything is rated as a hold, as is usually the case.  Afternoon snack for a Sharp Shinned Hawk in the backyard. |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |  With the exception of the election, 2013 is starting off relatively well, with something of a promise to extend the debt ceiling for another whole three months. That was enough to give a bit of forward momentum to the markets as a whole. Monies are starting to flow back into equity funds because people living on fixed incomes sure can't make much anywhere else. This over time should propel the markets further. It is an interesting start to the new year.  |

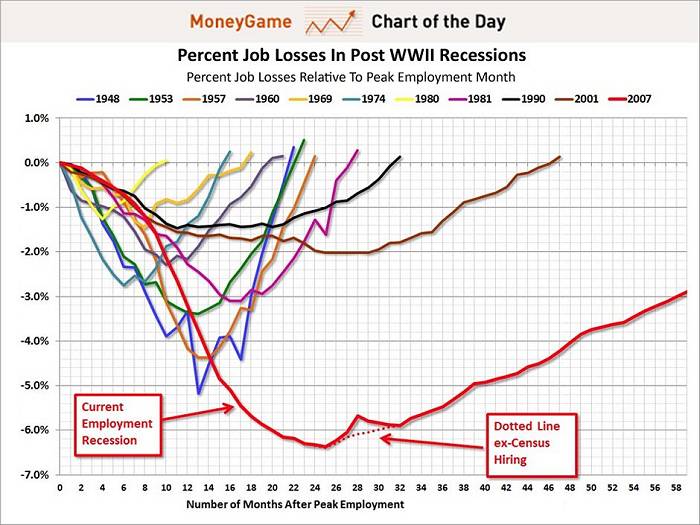

Re balancing   Racking up some big gains in stocks is a great way to finish up the year. These three stocks ended up comprising about 17% of the portfolio, which is a little high. Conventional wisdom is to keep the weighting somewhere around 4% for an individual equity as a way to diversify and mitigate risk. So with the advent of the new year, some portfolio re balancing is required and that means selling some of the cream and reinvesting in something else, preferably in differing sectors. One choice was easy.  Cisco recently increased their dividend over 55% and it looks like the prospects going forward are quite rosy. With a reasonable PE and decent yield, one chunk of the excess went to Cisco. I sold out a while back after a early morning run-up on surprise earnings and have been looking to get back in at an attractive price for a while. The other.....that took some thinking and I finally decided on something in health care.  I was not looking for something speculative and ended up with Eli Lilly. While it is near its 52 week highs, it appears to be attractively priced and the PE and yield indicate some value for the $$. Being a large cap with a long and decent track record, this should mitigate a lot of the risk I normally associate with this sector. Speculations  This year's speculation features Staples for one, with a 4% position started in the low 11's. If you need pallets of paper and other office supplies on a weekly basis, I doubt little can beat Staples with their trucked deliveries to your place of business. Bricks and mortar stores are not all a thing of the past and I think Staples has a reasonable chance of being one of the last men standing in this business sector. I am perfectly content owning Staples at these prices, collecting a 3.5% dividend while I wait.  Staples reports earnings in March and I imagine that will be an interesting conference call. And, presuming business and the economy is going pick up at some point, it would seem to me that a reasonably valued packaging company might be worth speculating in as well.   Along with a cheap price where one could speculatively buy a lot of shares, weather impacts these packaging companies so why not buy one that does a lot of manufacturing in the warmer climates. Graphic Packaging also releases earnings in February and that could provide a nice temporary boost if it hits the numbers. One of its competitors did and the stock popped nicely but it was considerably more expensive. I figure it's worth a 2% of the portfolio wager and if it blunted the effects of that big drop in Coach (COH), that would be a good thing. Questionable  And.....What about Apple? Apple changed the way they to their quarterly reporting. In the past, they used to sand bag their forecasts so when the numbers came out, they were always better than expected. They said they are no longer going to continue the practice and the market was expecting a number from them which was based on their sand bagged numbers and.... they weren’t. The numbers weren’t that bad but the stock took a big hit. Me, I’m inclined to go ahead and continue holding. It was only about 2% of the portfolio anyway. Now it’s about 1.5%. I don’t think Apple is going anywhere anytime soon and we’ll get more shares on the reinvested dividends. At these prices the PE is around 10 and the yield is over 2% so I can live with that. A Few Economic Charts     Comment: “The punishment of wise men who refuse to take part in the affairs of government is to live under the government of unwise men.” ~.Plato |