Inflation hasn't ruined everything. A dime can still be used as a screwdriver.

~ H. Jackson Brown, Jr.

Night of the Long Noses

| January - February, 2015 Inflation hasn't ruined everything. A dime can still be used as a screwdriver. ~ H. Jackson Brown, Jr.  Night of the Long Noses |

|

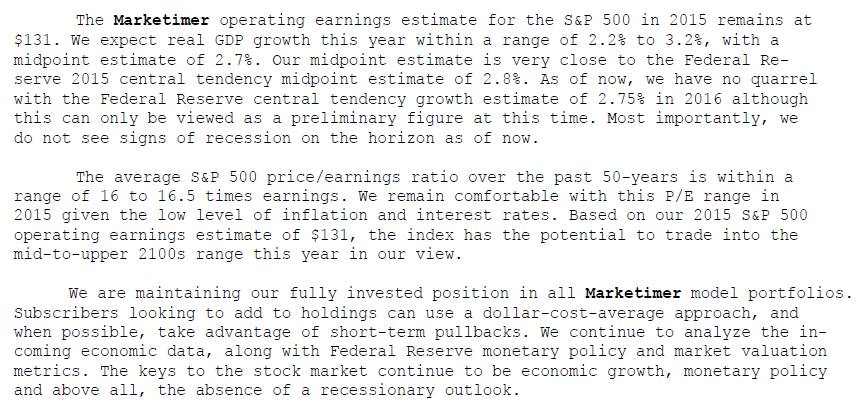

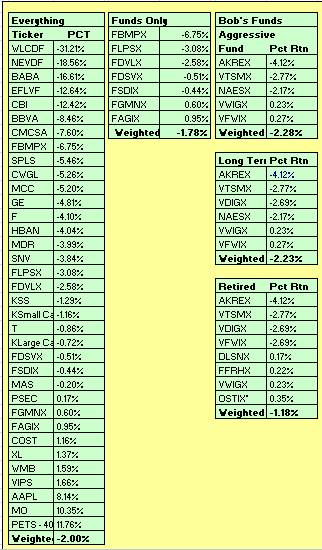

The Professional Opinion - DJIA 17,164.95  Bob is sanguine going forward. Everything is rated hold with the exception of selling FFRHX and buying DLTNX in the income portion of the portfolio. |

Interesting group of month-end winners. Altria continues to perform well on a price appreciation basis and that 5% plus dividend they are paying. Apple looks to be on a roll as well and hopefully it will continue rolling with a successful roll out of their I-watch. |

While the teleprompter is our making the rounds trying to destroy the country as we know it, the economy continues to muddle along. My guess is no rate increases anytime soon - too many headwinds and too many people on the dole and not a lot of lending going on and..........the next elections cannot come soon enough. Gutless new congress and senate, worthless teleprompter.......the best leadership money can buy.  |

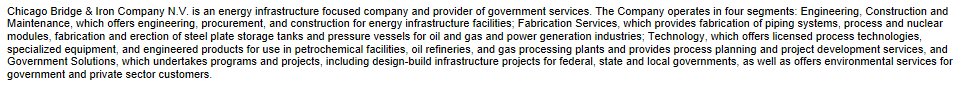

Western Lithium - Another Organo Clay Delay at the end of this January?.............of Course......... With the exception of announcing that there was some producing going on but........no word of contracts...........same old same old. New Year's Change #1 - Chicago Bridge & Iron   I sold UTX because I didn't see much more of an upside and began looking around for a company with the potential to provide lots of upside and settled for Chicago Bridge & Iron, which is down over 50% in the last year. The steep decline I thought was somewhat puzzling because while it seems to be trading in tandem with oil and gas stocks, this is not an oil and gas company. There's more to the story however, and that would be the acquisition of the Shaw group and with it, inheriting problems associated with two Nuclear Power Plants:  Arbitration aside, shares in CBI look like there is considerable room for price appreciation. New Year's Change #2 - Medley Capital Corporation (MCC)   Business Development Companies have had a tough time of it this last year and it was getting rather hard to ignore the yields. I've owned Medley Capital off and on, and it is looking like risk to NAV from here is probably negligible. A 15+ percent yield at these prices and overall valuations....... looks like a no-brainer to me. especially if held in retirement accounts.  Prospect is another BDC I hold in retirement accounts and this one did get a haircut both in NAV and in dividends. I still like the sector and will continue to hold. Here's a snippet regarding PSEC:  Not as safe as CD's, but the yields sure are a lot higher! New Year's Change #3 - Williams Brothers (WMB)   Williams is another old standby of mine and I sold DOW chemical to make the purchase. Williams is off some 30% of its highs and with that haircut, its steadily increasing dividend is now yielding about 5.5%. Not bad at all. I think there is more upside than downside to quality companies engaged in some form or fashion in the commodities sector and.......I do need a bit more diversification. I think WMB fits the bill nicely. New Year's Speculation - A New Speculation: Electrovaya (EFLVF)      Interesting and..........a lithium battery powering a ferry? I think this might be worth a small speculation. MDR - McDermott International, for those who reallllyyyy like to gamble.   MDR is a company that I would not normally touch with a ten foot pole, unless it was for a very short term gamble. In the past I have viewed it with as much pleasure as I would in trying to catch a falling knife. However at two dollars and change and the way the company has been hammered, you know it does not have much further to fall. It's already in penny-land but it does have to stay above $1.00, which I believe is the limit for a NYSE traded stock. I am starting to look at this one the same way I am looking at Chicago Bridge & Iron in that falling oil prices have knocked the stuffing out of even companies not in the O&G production business. This is an engineering, construction and services company. That said, when the cost of producing oil exceeds the price you get for it at market, what happens? Layoffs, cancellation of future contracts, fewer maintenance contracts and a general malaise if it lasts long enough. Someone with a positive spin on MDR might view it this way:  On the flip side of the coin we have this:  My opinion: This is a pure speculation in a struggling industry where OPEC is trying to drive the fraccers out of business. It is a high-stakes game of chicken and of course our politicians are doing nothing to help, with the possible exception of providing aid and comfort to the enemy through their inaction or inability to do anything marginally useful for the country at large. So.......what the heck. It is looking more and more like there is some money that could be made here and the odds are probably better than Wheel of Fortune! FXCM and the Perils of Forex Trading and....a Nice Little Opportunity!     I'm sure you've heard those radio ads where you can learn to trade the currency markets (FOREX) for free and all those money-making possibilities that will present themselves in the form of currency trading. That's all well and good but what happens if a major currency like the Swiss franc is suddenly set free, no longer pegged to the Euro? In a word....disaster, and not just for the traders....trading institutions can be affected as well. FXCM lost 80% of its value overnight and it lost its ability to cover trades, which also means it lost its ability to adequately capitalize itself. I was thinking..........possible opportunity here...and sat back and watched. Within hours a deal was struck with Leucadia to provide funding for its capital requirements and the following day, the stock began to lift off. I got some shares at 1.62 and some more at 1.74, and sold it all three days later for a profit just shy of 69%. I could have done better but the money was unsettled so I had to wait a day longer than what I would have liked. I would not have bothered with the trade at all had I not been very familiar with Leucadia, whose management I view as entirely above-board. It would have not been worth the risk otherwise. Currency traders usually bet on very small changes in the value of one currency as opposed to another and then use leverage sometimes greater than 100x for their trades. One would have that that after 2008, people would have learned.......... Where FXCM goes from here, I do not know. I'll bet they lost a chunk of client base as a minimum. Worth keeping tabs on though. And last but not least, the Capitalist Pigs latest Monthly Newsletter. This newsletter deals primarily with the decline in commodities and is a good primer on same. One thing......don't pay attention to the charts if they are confusing (I am not a chartist so sometimes they are). Ignore the charts and read the text, which makes a lot more sense to me than the charts often do.  Security Blanket |