Personal

Portfolio

|

A Pause in the Downward Spiral -

I thought

I

decided to go ahead and sell all my position in ETFC and use it as a

tax loss. Turned out to be a fairly good idea, all things concerned.

Where did the money go? See Below.

UNH

has turned around and is actually showing a gain MO

and WMB are going positive on occasion.

GE continues to be one of the biggest drags on

the portfolio on a percentage basis.

The bank and insurance stocks....Not improving

nearly as quickly as I would have thought. I am going to

continue

holding these as I think the Obama Nation won't dare do more

damage

to the economy in the short run, but judging by what I have

seen in the last month, I may have been optimistic.

|

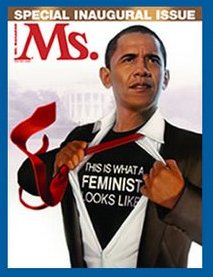

Boy, Memories are Short

|

Sorry

folks,

Barry

is not the nation's first elected black president. That title

went to William Jefferson Blythe Clinton back in the 90's when the

congressional black caucus bestowed our good buddy Bill with the honor.

Our newly elected community organizer is not without hope when

searching for a legacy for his future presidential library.

His

personal claim to fame it seems, is assuming one of the most sought

after titles in the New World Order ........that of First

Feminist!

And

of course he can also proudly proclaim the stock market performance

during inauguration day as absolutely the worst in history.

What

does this tell me?

The market is

forward looking........ |

A Triple Bagger

It's nice to win one once in a

while and PALM did not disappoint.

I

now have enough spare change for my 300' of fence and a GoldenDoodle

(long story there). As an adult male, I think I am going to

have

some trouble admitting I am the future owner of a GoldenDoodle. Kind of

like admitting to being a proud owner of a Cockapoo or a Lhasa Apso.

It

just doesn't quite roll of the tongue as well as, say a German

Shepherd, Airedale, Rottweiler, Bulldog, Catahoula or Doberman Pinscher.

Anyway,

I have very little PALM left and have a hard time believing it will

reach much more than nine dollars a share, especially in this

economy. You never know though. That's why I am

holding

just a bit of PALM.

I might be tempted to pick up some more if the stock dips back to the

5's.

In the mean time, I split some of the surplus into two more stocks.

First on the list is Sprint (S)

Sprint has been creamed by the competition, especially by those who

distribute IPhones and BlackBerries.

My thought on Sprint is simplistic.

I

highly doubt being the exclusive provider of the new Palm phone is

going to make or break the company but I think the stock could get a

nice bounce when it brings the phone to market. However,

there is

talk of Apple filing lawsuits for patent infringement again but they

seem to mostly be bluster when it comes to suits but it is something to

consider.

Word is that

Sprint is also going to be offering a flat rate, $50.00 a month plan

with unlimited text messaging in an attempt to capture the younger

crowd who use text messaging as the

primary form of communication. I

would dare say a plan like that would be quite attractive to people in

that group.

That's not to say the competition would come out with something equally

competitive and I bet they do.

I

think one third of my Sprint shares in a taxable account and two thirds

in tax privileged accounts could do quite well with a little patience.

|

Next up is the Huntsman Corporation

(HUN)

This is a specialty chemicals and plastics company. I managed to pick

this one up right at its lows (so far).

It is still paying a dividend and at these prices the yield is around

13%.

The company settled several law suits to their advantage as a result of

a failed merger attempt.

I am viewing this one as a long term hold.

Last but not least, I picked up some more XL in the

very low

three's, sold it in the high three's and bought back in the mid two's.

This has been a great trading stock and in a tax privileged

account, it has been providing some nice returns.

I don't imagine it is going to be paying a dividend much longer so I

wouldn't pay much attention to that.

If you have a little patience with this one, you could do well.

However,

with the financials you must be aware you are playing with fire.

I

never thought I would see Bank of America at $27.00 a share.

I

never thought I would see it at $13.00 a share and I certainly never

thought I would see it at seven and change.

This has been bloody.

Regions Financial, a favorite of mine got clobbered too.

The only one this month that managed to stay in positive territory was

Altria (MO).

People are still going to drink and they are still going to smoke.

That's

about it for financial commentary other than to say my wife's GNMA fund

yielded around 7% last year and this year it is the only financial

asset that has not lost value.

Something to think about.

|