Personal

Portfolio

|

Guess where I'm going next month......

February

was not a bad month all in all and cleanup was the main focus of the

portfolio. I got rid of CIM and replaced it with the better

quality CXS. HollyFrontier was sold the proceeds were used to buy a

little more DOW, a position in Staples and a few more shares of Amazon.

Nice to see those banks making a slow, steady comeback

|

|

Personal Portfolio

Boy this is a great way to end the month.

This

moron would virtually triple the tax rates on dividends,

further devastating the ability of those retired to

generate an income from the dividends they depend on.

A man of the people??????? No friggin' way.

Our

grand experiment in electing a teleprompter to the highest office

in the land is an abysmal failure and a serious change needs to result

from the coming elections.

And as to Mr Buffet,

he needs to keep his pie hole shut. If he doesn't think

he's paying enough in taxes then I assume he still knows what a check

book is. Jeesh.

DOOMSDAY

I don't of what significance 2012 is to the prophets of doom, but boy are they getting cranked up.

It

is interesting that if you look a little closer at just who these

people are, you find they all have a vested interest in selling doom

and this comes in the form of:

> Books

> Advice

> Gold

> Annuities

> Redirecting your Rollover 401K and other retirement accounts.

And.....if you look even closer, why they all know each other.

Imagine that!

Me, I think I will stick with people I respect who actually physically crunch the numbers using real data.

I don't believe there is much value in forecasting trends based on phases of the moon, biblical prophecy or the price of gold.

Fear and Negativity sells product and I suspect that's what the doom sayers are really trying to do.

So what does one do about the price of oil?

1. Vote out the current administration.

2. Perhaps pick up a company that has oil in the ground, preferably in the US to use as a bit of a hedge.

I

originally thought the refiners were the more attractive out of the

group and in that I was partially right, in that the refiners in my

view were under valued. I was right, insofar as HollyFrontier was

concerned.

Marathon oil is a company not without its problems, especially with its holdings outside of the US.

Add to that missing the usual dividend declaration date, spinning of MPC and the stock really got a haircut.

Everything

else I think looks pretty good and considering the price of oil and the

relatively low PE of the stock, I figure it's worth 2.5% of the

portfolio and at the purchase price of $34.68 on a dip this

morning, I think it's worth the investment. I rather highly

doubt the 'religion of peace' over there in the Mideast is going to

show much brotherly love anytime soon.

And how about that Huntsman (HUN)....

Huntsman

continues to impress and I think a contribution to the run-up in stock

price is Jon Huntsman getting back to the business of running the

company and not running for the presidency.

The stock recently went over 5% of the portfolio, again, but I think I will let it run for a while longer before scaling back.

It's

sure be nice to see the price over 21.00 again. I could use some

more fence work and there's a power line I'd like to bury.

02-28

Office

Depot reported earnings this morning and to everyone's amazement, the

company actually went into the black. The stock jumped nicely,

but personally I'd stay away from this one.

However.....

Staples

(SPLS) is reporting tomorrow (02-29) and they are getting a bit of a

bump from Office Depot. I'm picking up some shares today,

thinking that the profit picture just might be rosier than the prophets

of doom think.

The company is priced reasonably and does seem to

be recovering. Their stores are clean and their inventory is decent

enough that I occasionally browse the store myself. I even buy

something on the odd occasion.

It'd be nice to see them pick up where HollyFrontier left off, portfolio speaking.

02-29

Well,

you win some and you lose some. Staples came in line with

estimates and the stock got creamed. I think this is worth

holding on to for a while anyway.

No real bad numbers or anything, but nothing overly impressive either.

Current Allocations

| This looks a little better, I think. I'd like to get the banks

whittled down to a smaller percentage over time. It doesn't help

matters when one sees BofA dropping to six and change. That was just

too tempting.

The

real estate allocation could also be upped a bit because there's a lot

of real estate buying going on and some of the larger companies I like

are scooping up properties. I'm more interested in the paper

holding REITs, rather than the physical property itself and I think

more of a weighting there would be beneficial.

Energy.....the sector is so volatile anymore that a minor weighting works best for what I want.

Being

overweight in banks, telecom, raw materials and food at this juncture

should be extremely beneficial should the political landscape make an

extreme right turn later on this year.

|

| NEW MONTHLY FEATURE: THE PROPHET WATCH

What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here

Financial Analyst - NOT

Soothsayer - NOT

Bearer of Practical Financial Opinion - Occasional

Man's Worst Nightmare - Maybe......

Having to listen to annuity pitches interspersed with vitamin infomercials could be worse.

|

Let's keep track of just how well this PITA's 'predictions' pan out for the rest of the year.

| 2012 |

Predicted |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| Gold |

$2,000.00 |

1736.7 |

1716.28 |

|

|

|

|

|

|

|

|

|

|

| Recession |

60%

Chance |

Nope! |

Nope! |

|

|

|

|

|

|

|

|

|

|

| TIPS

Current 5yr Yield |

Home

Run - Maybe |

0.95% |

0.90% |

|

|

|

|

|

|

|

|

|

|

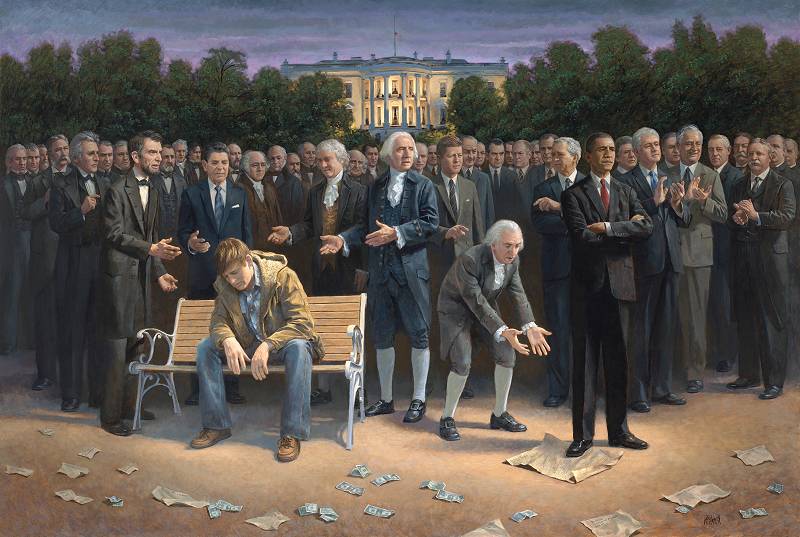

The Forgotten Man - another great reason to vote out the current administration ASAP. Here is the Full Sized Image

|

|

|