The Professional Opinion - DJ 16457.66

Buy Recommendations

None

Sell Recommendations

None

A Nice Winter Sunset.

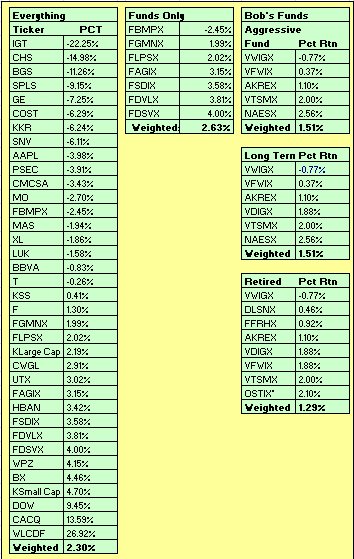

| March - April, 2014 "He predicted the market crash in 2008..... "He also predicted a crash in 2006, 2004, 2003, 2001, 1998, 1997, 1995, 1992, 1989, 1984, 1971..." ~In reference to the prophets of 'Doom and Gloom' that pervade the airways. |

|

The Professional Opinion - DJ 16457.66  Buy Recommendations None Sell Recommendations None  A Nice Winter Sunset. |

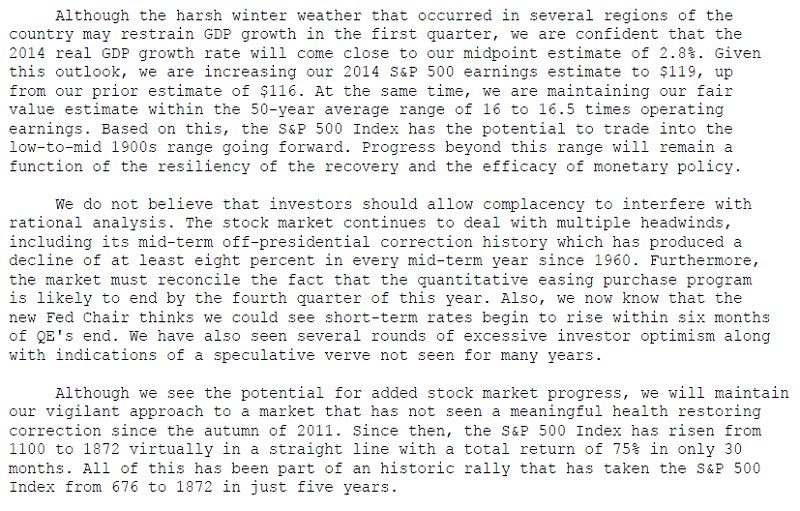

Well it looks like Western Lithium won the month once again, hands down. Kind of a weird month anyway. The only thing I had any real fun with was BBVA, which has turned out to be a great trading stock and as a company, not that bad of a one as well. This month, I am limiting the LPs and MLPs in favor or more traditional investments. |

March so far has been a tepid month with the exception of the missing 777 and with that, news reporting has bottomed out once again. It is hard to distinguish the daily fare with that which one expects out of on 'Coast to Coast.' Locally, there is considerable optimism that Nevada is still in the running for a Tesla Lithium Battery facility and since it also produces some and will produce more Lithium, the odds aren't looking that bad. For a company which has yet to produce anything, Western Lithium's share price is staying much higher than I had expected....... Drat!  |

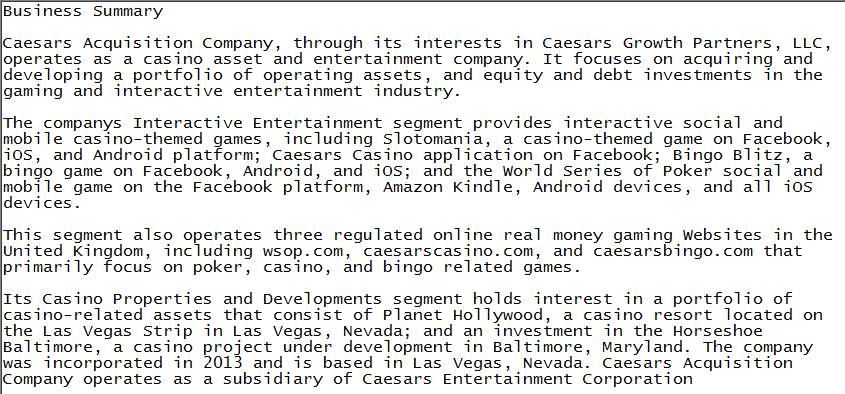

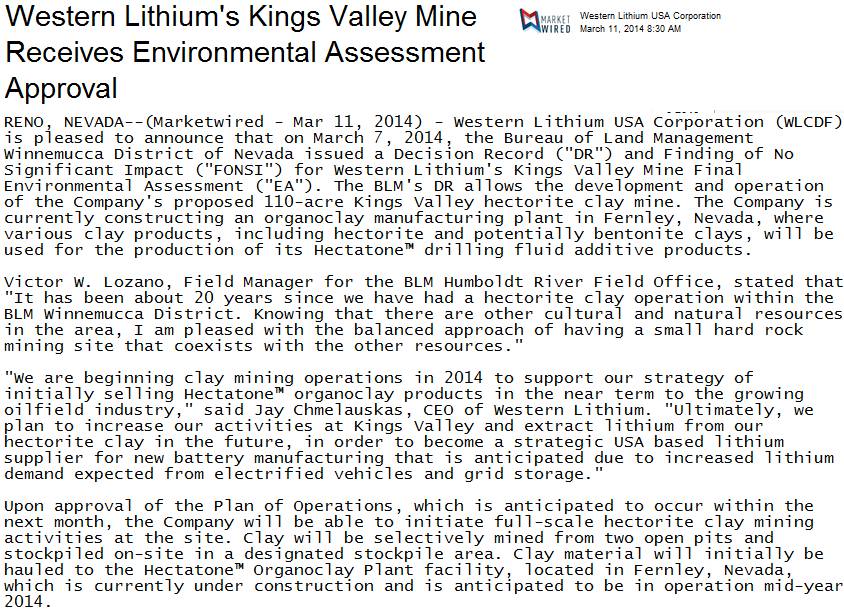

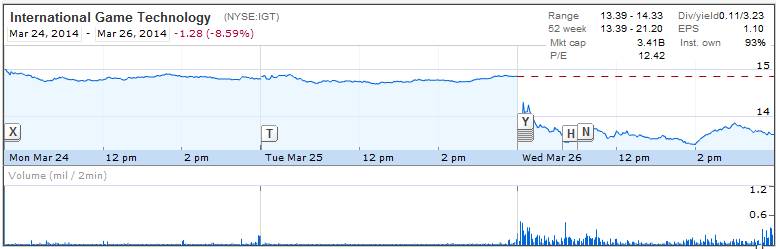

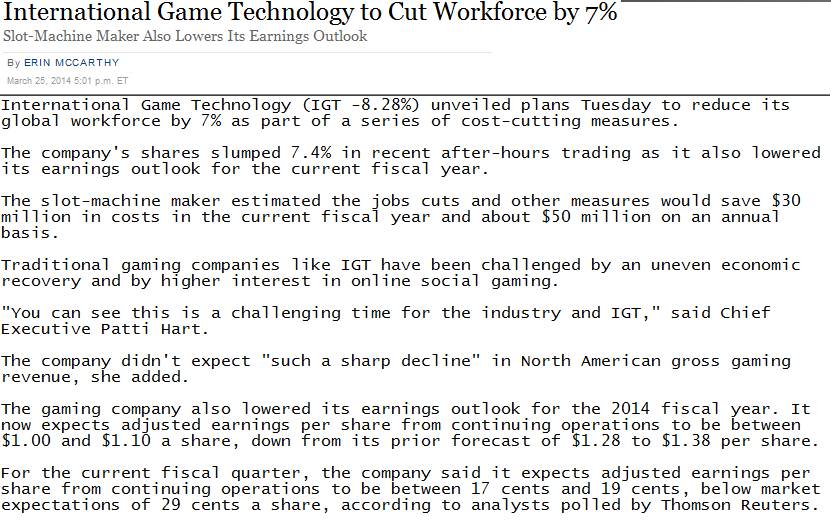

| Caesar's Acquisition Corp - CACQ A Decent Traceable Stock   CACQ was a pick of mine from a couple months ago and I managed to ride it up for a 30% gain and then decided to sell and diversify out a bit. I still use this as a traceable stock for shorter term trades because it is quite volatile and it is one of those companies where if one has to hold on to it for longer than planned, then that's not a big deal either. CACQ moves so much that this is one of the rare instances where I use limits on buys and sells because it can move so dramatically in a few trades that it would be easy to get stuck on the wrong side of the trade using market orders. Western Lithium - WLCDF An Update on My Favorite Penny Stock   I really wasn't expecting to see positive news like this anytime soon, if at all. Getting BLM approval for development of a mine especially in this day and age, is a big deal. I'm not sure what that 'Plan of Operations' is all about but I can say the Lyon County, the largest county (if memory serves) was one of the hardest hit counties during the housing recession and I am sure that given their druthers, they will be all about putting more people back to work. It is looking like if I want to continue playing, it is going to cost 60-70 cents a share and I think I will put in a few orders around 65 cents a share. And, since Tesla has yet to make a firm decision as to where their proposed lithium battery facility is to be located, I would tend to view these shares going forward as a long term hold. And yes, there is a railroad spur nearby. I'm getting marginally excited! IGT - One I got Right   Last month they were saying it was the probable slowdown in China that was causing problems. This month its a slowdown in North American gaming revenues. I think this one now bears some watching because at these prices, a 3% yield is attractive, provided there are no future plans for cutting the dividend as well. And......the latest Capitalist Pigs News Letter  |