Personal

Portfolio

|

What a difference a

month makes when our beloved community organizer finally figured out

that words mean things. Now he could just keep his mouth shut

for the rest the the year...

And

then let's not forget the tax cheat Geithner who seemed to think the

Chinese idea of a universal currency, not the US dollar was a good

idea. That of course roiled the currency markets, driving the

value of the dollar down. How much more incompetent can you

get?

I'm afraid we might just find out.

What

comes around goes around and I suspect the political circus is going to

be most amusing the next couple years. If the conservatives can't make

hay out of all this and win back some congressional seats next

election, they don't deserve to be in power. |

|

|

My Personal Game Plan

I

side-stepped the dot.com bust with some professional help,

missed the burst

of the commodity

bubble on my own, bailed out of international funds with comparatively

little loss and got totally caught up in the Sept cratering of

everything stock related. I

didn't see that one coming because I didn't understand the full impact

of sub-prime paper. Won't make that mistake again.

Since

then I have been doing a fair amount of trading in volatile stocks (XL

in particular) and

using the profits to buy quality at greatly reduced prices.

As a result of this, I have about 60% more shares

than I did at the

end of 2007. If I would have stayed in mutual funds

as

Bob Brinker did, I would have about the same number of funds

and much heavier losses.

I am

thinking that when turnarounds occur in market conditions such as this,

those turnarounds can be violent to the upside. If that happens, I

think all these good companies trading at penny stock prices will make

me a happy camper indeed. If the Sprint / Palm venture is

a success, that will be some thick icing on the cake.

|

PSPFX - US Global Investors

Resources

Coming out of this recession,

financials are going to have to lead the way and I think I am

fairly well covered there.

Commodities should be close behind, copper in particular. I

don't have any desire to play the commodities market and

leave that to the pros.

I've

made a lot of money off this particular mutual fund and will

probably

buy back into it at some point. I don't know that now is the time but

if you are looking at an allocation into commodities (no more than 5%

of course), this one bears watching. |

BLDRS Emerging Markets (ADRE)

This

ETF is more concentrated than most and has a beta of about 1.5.

I've owned this one once or twice and did well with

it. It has a large energy component: |

| Volatile, no management fees

and pays a dividend. Could be a good choice for

energy and emerging markets. |

What about those Home Builders?

In

an attempt to be forward looking in terms of identifying new growth

areas, I started hearing a bit of noise in the housing

sector. On second thought that noise might well have resembled a final

gasp.

Anyway,

there seems to be the tiniest bit of recovery throughout the country in

home sales and construction. Not looking to spend much at all

in

this sector, I finally settled on Standard Pacific at $1.00 a

share.

The company has a lot going

against it, not to mention another recent downgrade from Fitch:

"The

downgrade reflects the current very difficult U.S. housing market and

Fitch's expectations that the housing environment remains challenging

for the remainder of the year and perhaps into 2010. The sharply

contracting economy and impaired mortgage markets are, of course,

contributing to the housing shortfall. The ratings changes also reflect

persistent negative trends in Standard Pacific's operating margins and

further deterioration in credit metrics, notably leverage (with some

debt reduction in recent years offset by erosion in tangible net worth

from non-cash real estate charges and operating losses).

Cash

flow from operations will probably sharply decline in 2009 and may

shift negative in 2010. Real estate impairments should moderate this

year, but will persist so long as home prices decline and the sales

absorption rate shrinks.

The

company had $626.4 million of cash at Dec. 31, 2008. Standard Pacific

generated $263.2 million of cash during fiscal year 2008 ($62.5 million

during the fourth quarter), which included $235.6 million of tax

refunds received during the first quarter of 2008. For all of fiscal

2009, Fitch expects the company to be slightly cash flow positive,

excluding a first quarter tax refund of $114.5 million. The company has

some near term debt maturities, which will deplete some of its cash

balance. Standard Pacific has the following near-term debt maturities:

$124.5 million in April 2009, $173 million in August 2010, and $175

million in May 2011. "

|

Here is a glimmer of the positive:

Well, that's my speculative pick for the month and it does add somewhat

in terms of diversification of the portfolio.

Fools Gold

I'm

sure by now you have heard those annoying advertisements on the radio

urging you to send in your used gold, your valuables and even your gold

teeth for instant cash. Below is a post that has

been

circulating around for a while, supposedly written by an ex-employee of

one of those firms. I cleaned up the wording a bit,

reformatted

it and changed the name of the company to 'Fools Gold'. It is

worth reading:

I am a former employee of Fools Gold. I did not know much about the

company before being hired.

On my first day I was taught the Fools Gold Scam from beginning to end:

1.

We send you a 'Refiner’s Pack”, used by you to put your jewelry in

and it is 'insured for UP TO 100 dollars'.

This is according to how much we feel

your items are worth,

NOT what their appraised value.

2.

We receive your Refiner’s Pack within 3-4 days

but are

instructed to tell you that it takes 7-10 business days

for us to receive it ALTHOUGH

the package has

already arrived.

3. Your valuables

are appraised by hand, magnifying glasses, a small weight pad and a

bottle of mystery fluid.

Appraisals are not done with million

dollar equipment or specially trained jewelry experts.

4.

Although the payment for your item(s) is dated within 24 hrs of testing

your jewelry, we sometimes DO NOT

actually send the check until 3-4 days later.

5.

We claim a 100% Satisfaction Guarantee or your jewelry returned, BUT

THE CATCH IS that the guarantee

requires contacting us within 10 DAYS from when your check

is

DATED. This begins with the time it takes for

accounts payable to issue the check and also includes the

transit

time for you to receive your check.

**** THE COMMERCIALS STATE YOU GET YOUR CHECK IN 24 HRS.****

6. IF

you are lucky you will receive your check around the 7-10 business days

AND more then 97% of the time

Customers are outraged when they lay eyes on the amount of the check.

Some customers even receive a check for one penny

(TRUTH). That can include items of great value (Diamonds, Platinum/

Gold and Sterling).

7.

They sometimes even receive your valuables and like them so much THAT

WE CLAIM to not have received the

items just so the TOP people or

even FAVORED people can

get first dibs on your items.

If

we tell you your items never even got here, we issue an INSURANCE CLAIM

for UP TO 100 dollars

(GOD

FORBID your items are worth more then a 100 dollars) and when you call

in to check on the status of your items, we tell you:

”YOU SHOULD HAVE

ADDED EXTRA INSURANCE ON YOUR ITEMS BECAUSE WE NEVER GOT THEM.”

We do not use an actual insurance company. We use customer

service reps as claim department agents.

8.

For those who receive a check within the 10 day time frame,

GOOD

LUCK trying to get in touch with a customer

service representative before your 10 days are up.

After 10 days your items are “ALREADY MELTED” or "NO LONGER AVAILABLE

FOR RETURN.”

9.

For the “LUCKY” people who do get in touch with us within the alloted

time, we already know what you are calling about. Customers want their

items returned because the check amount is so insultingly

LOW.

The first thing a Rep will ask you is “HOW MUCH WERE YOU EXPECTING TO

GET BACK?”

This way we know how much to “BONUS” you.

Definition

of a BONUS:

We

issue low-ball checks just to have you call us back if you are smart

enough

to realize that you just got scammed. For the smart ones we are paid to

offer a bonus up to 3 times the original amount of your of your

original check and you accept.

For example: Sally Smith

receives a check for $27.86 for a Rolex watch (which we don't issue

value for), a class ring, a ring with diamond chips, a pair of earrings

with emeralds, as well as a few sterling silver pieces and maybe a few

items that were really of no value.

Now Sally Smith calls the customer service department where she speaks

to a rep who seems 'so

concerned' and will see if she

can better the amount by speaking to

a SUPERVISOR.

We

then place the caller on mute and speak to our neighbors or doodle on a

sheet, or twiddle with our hair for about 45 seconds while we are

supposedly speaking to our supervisor about Ms. Smith’s complaint.

We

then come back with an offer to BUMP UP YOUR MELT DATE or any other

lies the customer service representatives can think of and offer you a

total amount of $53.20, which is a little under double the amount of

your original check. If you accept, the representative makes a $15.00

bonus off of the transaction. If the representative offers

you

under triple the amount of your original check, she makes $10.00 in

bonuses.

10.

If you

accept the offer, the deal is done and you are told that the call is

recorded (by the way, most of the

time the record button does not work). It is a way to make

your

feel binded by verbal contract. IF you do not

accept the deal, you have to return your check

and it

takes sometimes up to a month to receive your items back

after we receive the check.

11.

If you only want the items that we do not find of any value back, you

may have to pay a 10.00 shipping and

handling fee to have your own items

returned. It

varies depending on sales for that week.

IF sales are good,

there is no fee. If we are slow, you must pay.

Fools

Gold is definitely not a trustworthy or credible company to do business

with. You are probably better off taking your items to a local pawn

shop or shopping around for other companies. With the economy the way

it is, Fools Gold seems to be a way out of financial stress for some,

but in actuality becomes a stress of its own.

I would advise

you think twice before sending in valuables or items inherited

and

of sentimental value. It is not worth it.

I am not doing this as a way of bashing their money making process :)

but to issue a warning. |

|

|

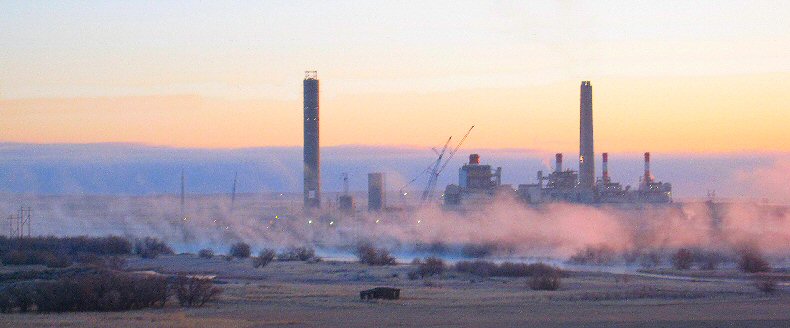

I guess the picture speaks for itself - your

official greeter at the Casper, Wyoming airport.

Closing Comments

Last

month my foul mood over all things financial and our government's

ineptitude

in dealing with it spilled over into of all places, a Canadian

woodworking forum where I found rather disparaging remarks regarding a

certain web page of mine.

I had a few choice rejoinders for

that particular bulletin board and I will have to hand it to the

Canadians, they are quite capable of generating love letters in return

with all the impact profanity could have without the profanity itself.

Well written too.

Anyway, I decided to turn a negative into a

positive and provide further instruction and pics on some of my

wood turning preferences.

As a result of this the page views

which the Cairn Terrier usually dominates in a big way, was shattered

by

this woodworking page by well over 100%. The other wood working page

views

shot up as well.

What does any of this have to do with finance?

I

think it is a lesson on the severity of impact that negativity can have

on the world at large from politics, to finance, all the way down to a

lowly bulletin board.

It works.

Choosing

not to

participate in negativity is my usual preference but it is pretty clear

it is something that not should be ignored when your finances could be

affected by it and I think the media at large and our community

organizer in specific were in large part responsible for driving up the

last few months of losses.

On the plus side, negativity sure is a great way to drive up your web

page rankings! |

In the interest of saving the company money, we elected to motorvate

around in which one of these fine vehicles?

|