| April, 2013 "The trick is to stop thinking of it as 'your' money." ~ IRS Auditor |

|

The Professional Opinion - DJ 14839.8 Bob sure would like to see a significant correction..  Buy Recommendations None. Everything is rated as a hold, as is usually the case. However, I would personally be looking at Suncor (SU) in the very low 30's if one were so inclined for a shorter term trade. ~ I did on April 17 at 27.02. Should do just fine!  This will be interesting. My prediction - I think Jon Jones will take a lesson from the Anderson Silva playbook and use striking instead of wrestling to win in short order. Chael I get a kick out of and he is a good wrestler but I think his size and age will work against him. |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. Coach it seems, is turning a corner. Check out one of their stores some time! |  The month has been interesting so far, with lots of earnings coming in. It hasn't been as bad as I was thinking it was going to be, but there are many companies reducing earnings expectations going forward. There have been a few exceptions. All this points to anemic growth going forward and with anemic growth, why there are idiots out there who seem to think that we can tax our way into prosperity is beyond me. Printing our way into prosperity is one happens to be a significant holder of equities :) is going to work for a while, but at some point even that will bottom out. Banks in particular are showing the effects of a slowing economy and high unemployment. You can't take out a loan if you don't have a job these days.  |

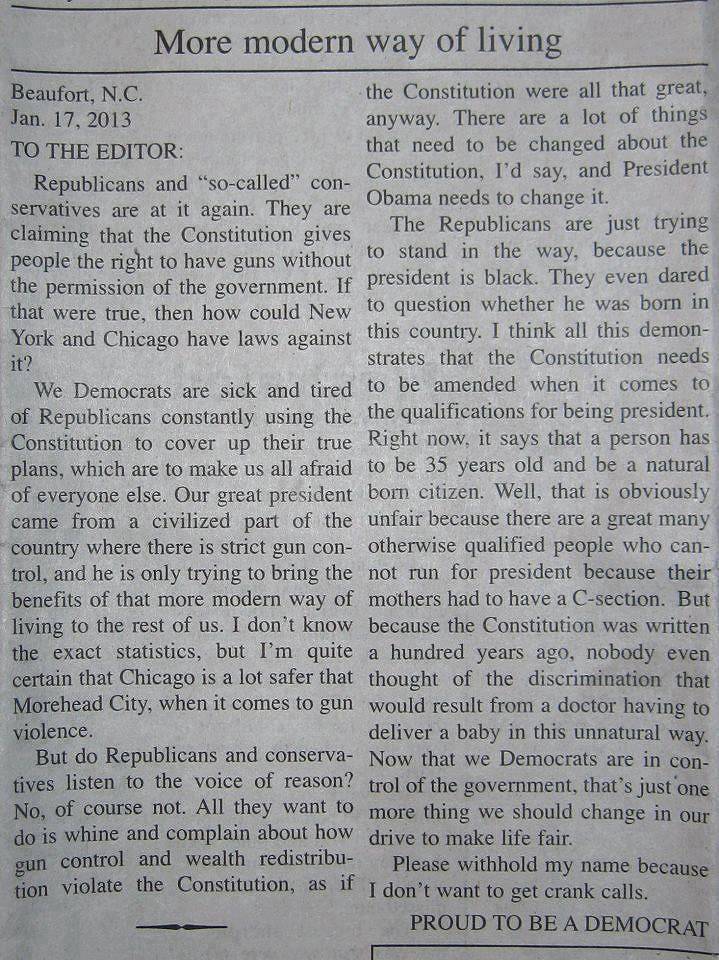

| Earnings Season........ Earnings season I think is going to be important this time around. Many pre-announcements have been on the negative side, including some big ones - CAT, FEDEX and Oracle. If earnings as a whole come in light or negative, then I think it may be time to make a few changes. There have been other things going on as well. Leading economic indicators have been turning negative.  Corporate profits as a percentage of GDP are at all time highs. The last time this happened was around 2007. Employment numbers have been lousy. Commodities have taken a dive, although I think a lot of this was driven by those with leveraged positions getting margin calls after the great race to sell gold. Meanwhile, the FED continues to print money, which is having the effect of driving stock prices up but it doesn't do much for improving employment and the economy as a whole. That takes an administration focused on improving the economy and taxing the hell out of it doesn't do much for forward earnings. As Bernanke has repeatedly said, there is only so much that he can do. At some point our so-called government has to step up to the plate and do their part.  I am kind of envisioning this as a big balloon and instead of being pumped up with helium to stay afloat, it's being filled with dollars. One of these days I think it is going to burst unless we see true economic expansion. But....... I am all for making hay while the sun shines.  The above is a samples of what's going on so far with earnings. Not looking real good. An interesting Radio Show Clip dealing with the topic at hand: Chris Butler - Economist working with Butler, Lands and Wogler and host of the Saturday morning show Capitalist Pigs, has some interesting observations: April 13 Radio Show The show is about 30 minutes long (with ads edited out) and covers such diverse topics as BitCoins, Gold, Stocks, Japan, REITs and Equities to name just a few. It is worth a listen. SPPI Revisited One Month Later   This particular bottom fishing episode hasn't panned out so well over the short term. I bought at $8.03 so I am still down a bit. Ah well, you win some and lose some. I didn't have that much in the stock anyway so I think I'll hang on to it a while longer. Diversification Time Again? In only Three Months? Selection #1   One problem that is nice to have, depending on how you look at it, is given the big gains in parts of the portfolio, re-balancing and diversification becomes a necessity. I've never had to re-balance twice in a year and this makes the first time for me. I wanted something a bit different than the usual fare I've become accustomed to so how's this for something different.  Although this is a small cap, it doesn't have much of a beta and it sports a nice yield. It is trading off of its highs, which is unusual these days. People do spend a lot of money on their pets.....I should know. Selection #2 Society also spends a lot of money on incarceration. It is a booming business these days.   Corrections Corp of American has been on a tear for a while. I took a position in this because the company is in the process of converting itself over to a REIT, and along with that conversion will be paying out a dividend of somewhere around $6.00 a share later on this April. When a dividend is paid out, the share price drops by a corresponding amount. That in itself doesn't make one any money but what does make money, is many times the share price will return to where it was trading pre-dividend. This is particularly true in bull markets. There is no rational reason I can think of for this to happen at all, but does often happen and one can do very well indeed. The other consideration is - what if that doesn't work out. Is this a stock you would be prepared to hold onto anyway? The answer in this case would be yes. However, I am actually more interested in making a few $$ on that coming dividend distribution.  I made out like a bandit on all those special dividend payouts last year. This would be icing on the cake. This is what going ex-dividend can look like. What would be nice to see is this: 1: Stock is trading at 40.75 when the 6.63 dividend is paid out. 2: 40.75 - 6.63 = 34.12, the new trading price post-dividend 3. If the price rises post dividend, then (Price Difference * Number of shares) + the Dividend = Total gain, and sometimes that gain can be significant. A Really bad day for the Gold Bugs       I like in particular the last sentence. Commodities for me are not long term investments. They are cyclical and can be quite volatile. If you buy them when they look really cheap and as they move up and then put the money to work elsewhere when they are not really moving, you can do OK.  With that in mind, I picked up some more Marathon Oil today for what I hope will be a shorter term trade. If not, that's ok. Marathon is a decent company. Personally, I've never traded on gold or other metals because I don't like that much volatility. Oil to me is a much more reasonable commodity to do some trading with. You know, a thought just occurred to me........what was it that my least favorite prophet, seer and revelator was saying in 2011-2012?  It's nice to be right, particularly since man's worst nightmare performed exactly as expected.  In lieu of an award-winning photo this month, may I present in its stead - an amusing opinion piece from the low-information voter crowd. Personally, I think this is a spoof but with the low information libs, what is improbable may actually be true. |