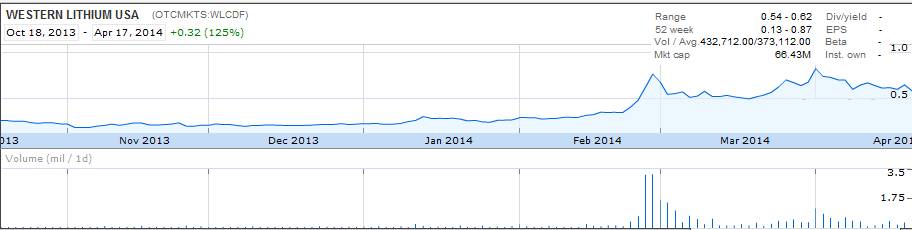

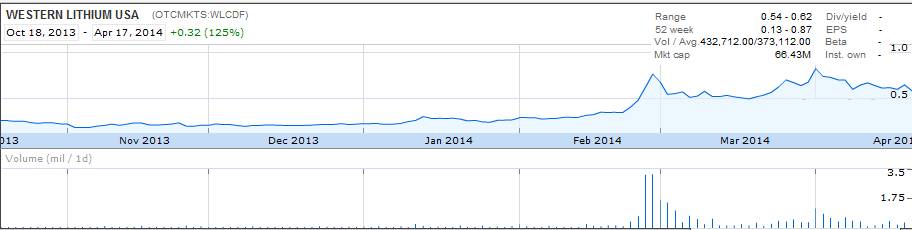

Western Lithium - WLCDF

Another Update on My Favorite Penny Stock

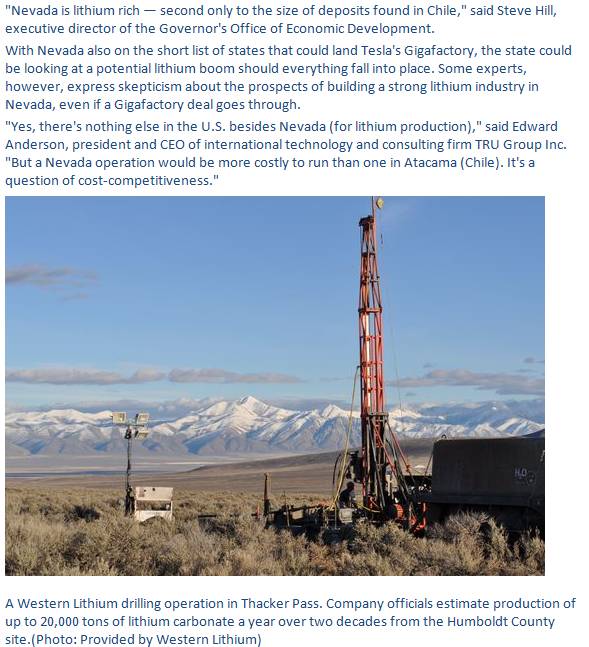

This

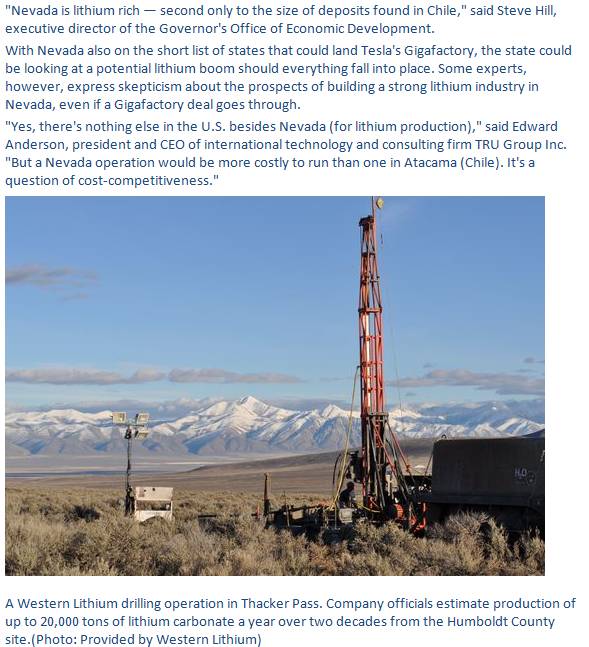

month there was a heck of a write-up in the Reno Gazette Journal on

Western Lithium. The article was re markedly well balanced and here

are a few snippets:

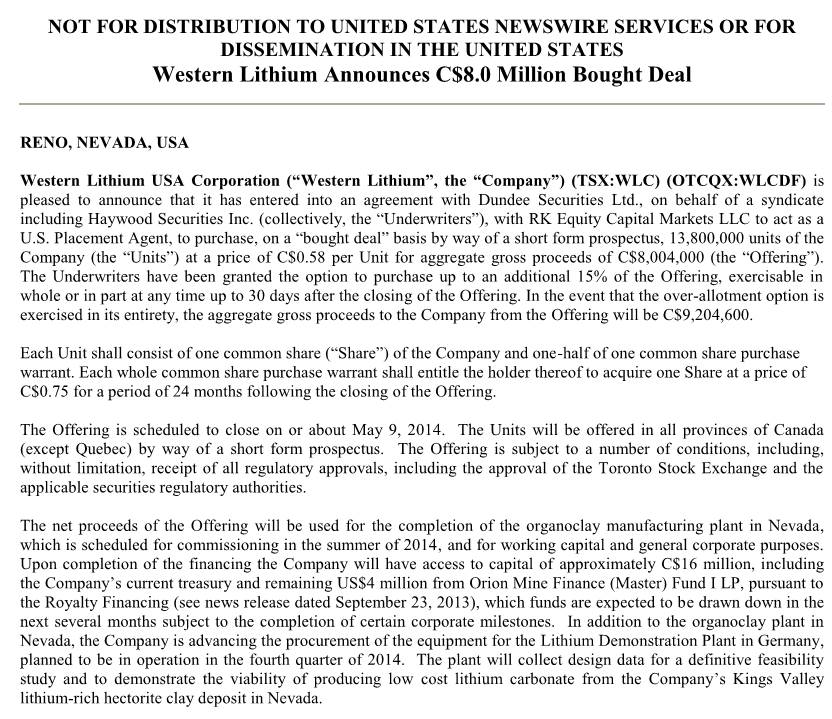

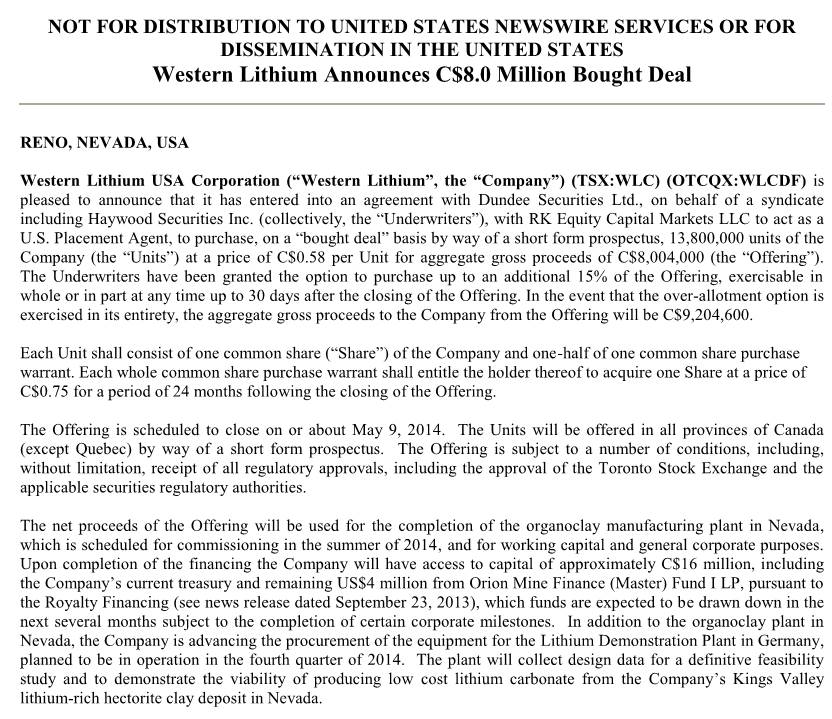

The

upshot of this seems to be the issuance of new shares to support

ongoing activity. From what I have been reading, the Organoclay

is going to be mined and manufactured first. This of course means

having buyers for the product and a manufacturer capable of supplying

enough product for the buyer at a reasonable price.

We'll see what transpires later this summer.

Meanwhile,

I don't think it would be that productive to simply hold the

shares. From what I've seen so far, this is a great candidate for

trading on dramatic moves in the upward direction and then buying back

as the shares drift lower.

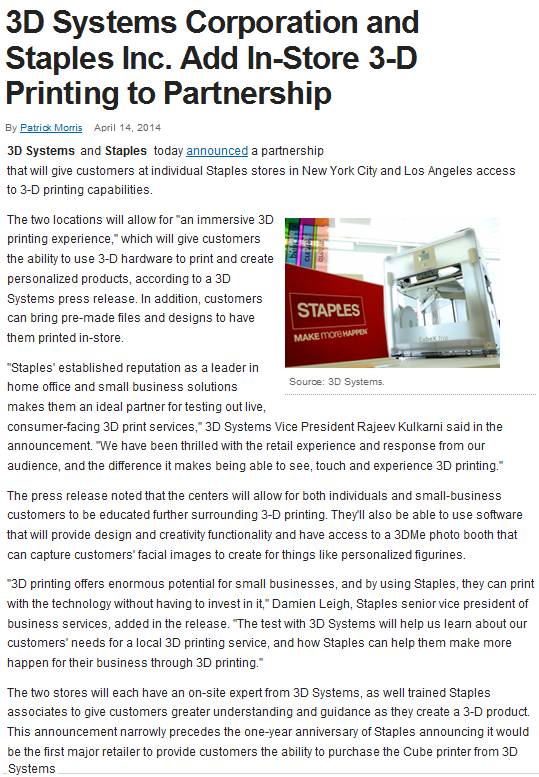

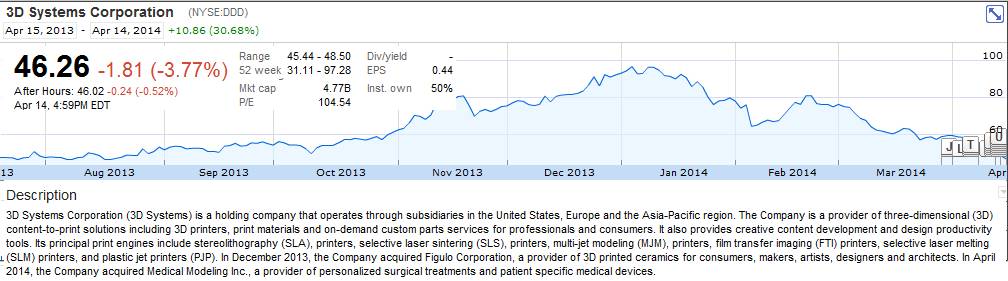

Staples (SPLS) and 3D Printing (DDD)

Staples

is one of my favorites for swing-trading and the last month has been a

profitable one with all the volatility going on. I have a core

holding in Staples. Believe it or not, it is second only to

Amazon when it comes to on-line retailing.

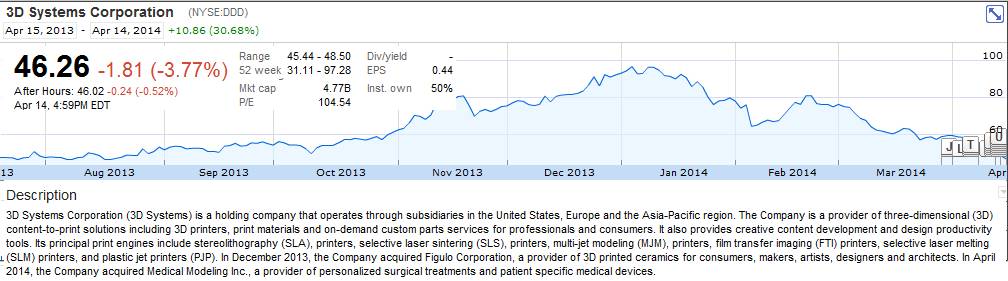

3D Systems I bought

for a short time in the thirties and sold out in the 50's. The

stock had quite a run after that, as well as a precipitous fall.

At 46 and change, the company still sports a PE of over 100.

Of the 3D printing companies currently occupying the space,

I think DDD is the best of the bunch and just about the only one

that actually earns a profit. I'm thinking about taking a

position in DDD again and was surprised to see the partnership with

Staples, albeit a small one but, two stores is a starting point.

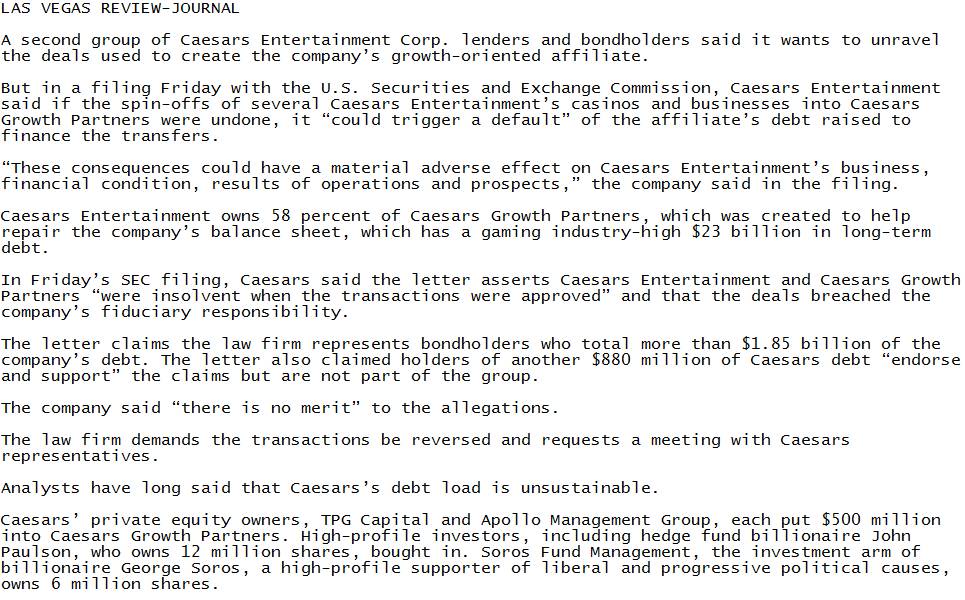

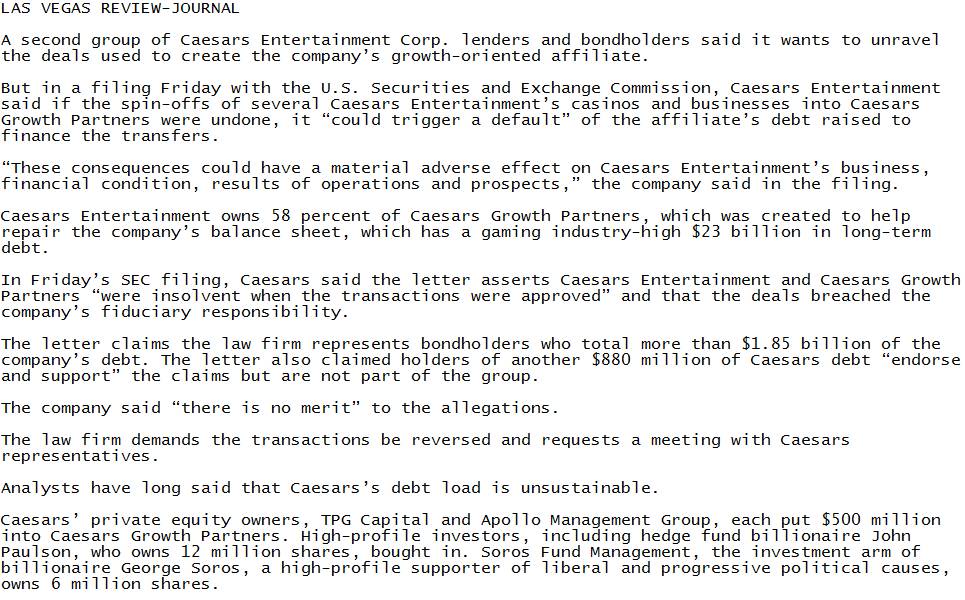

Caesar's Acquisition Group (CACQ)

Boy,

I am having second thoughts about CACQ and having it as any kind of a

long term hold as a play on the expansion of on-line gaming.

Having

read numerous articles and posts about the company, it is hard to tell

who to believe. Commentary ranges from a solid play within the

sector, to a company whose only existence is to take the parents toxic

debt off its balance sheet and off-load it onto CACQ.

I would say the general opinion is tending towards the latter, as referenced once again in the above snippet.

I am currently out of CACQ and think it might be wise to stay that way.

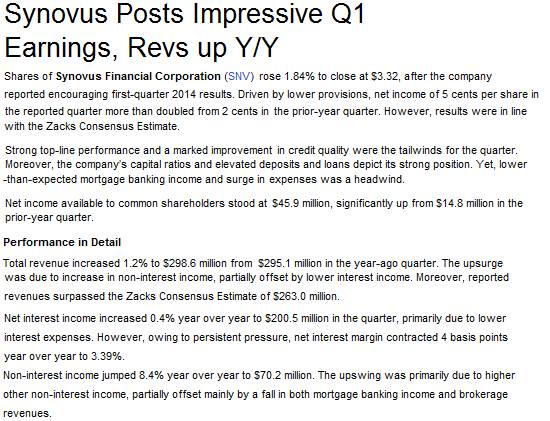

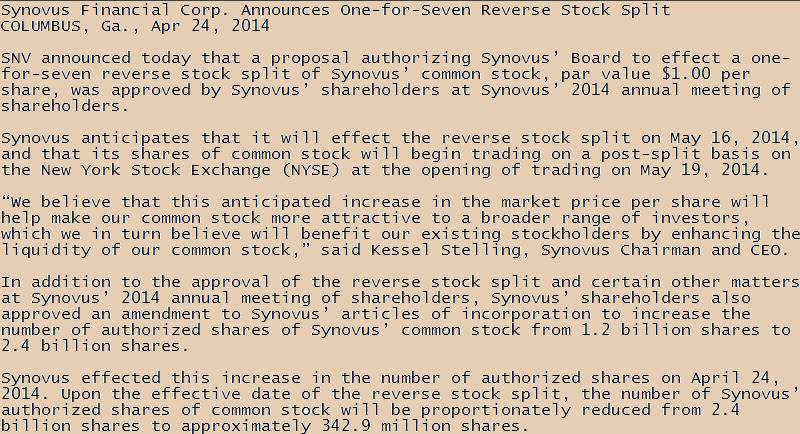

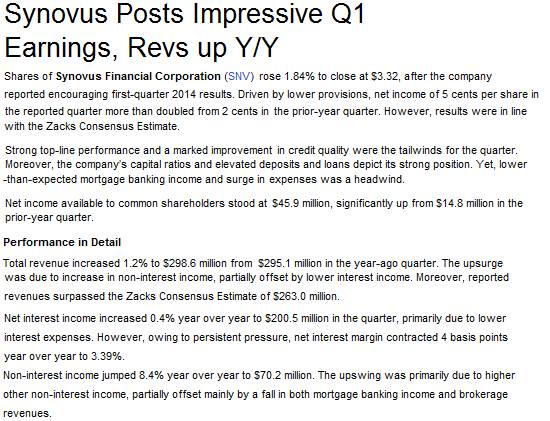

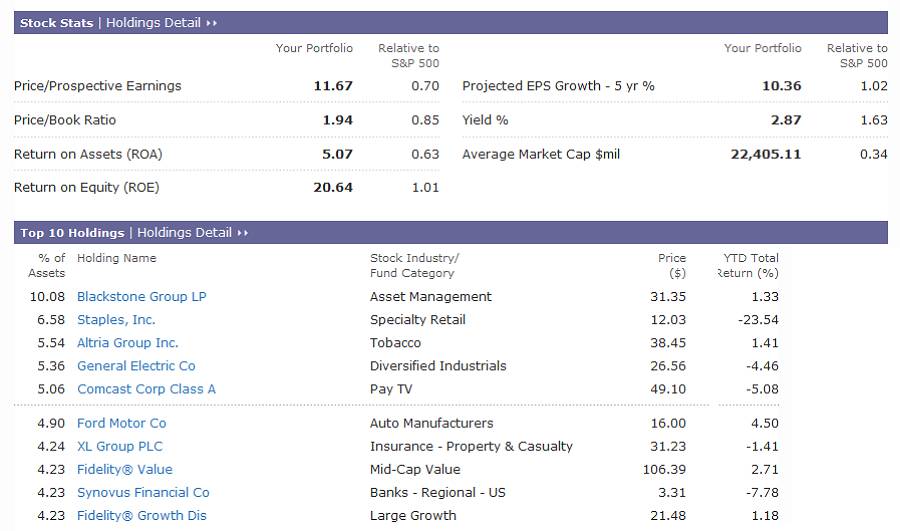

Synovus Financial (SNV) a Cheap Stock Still Worth a Look

Some

of these regional banks a looking quite attractive in light of the

allegations and investigations about High Frequency Trading (HFT) that

a number of the big banks are alleged to have been involved with.

It doesn't say much about oversight when it takes a novelist to

bring the topic of front running to light.

Synovus is one of my

favorite smaller, regional banks and I doubt they do much dealing in

HFT. The bottom line is slowly improving, as well as the

improvement in credit quality. I'd like to see this go over the

magic number of $5.00 a share, although I don't think that is going to

happen anytime soon unless..........

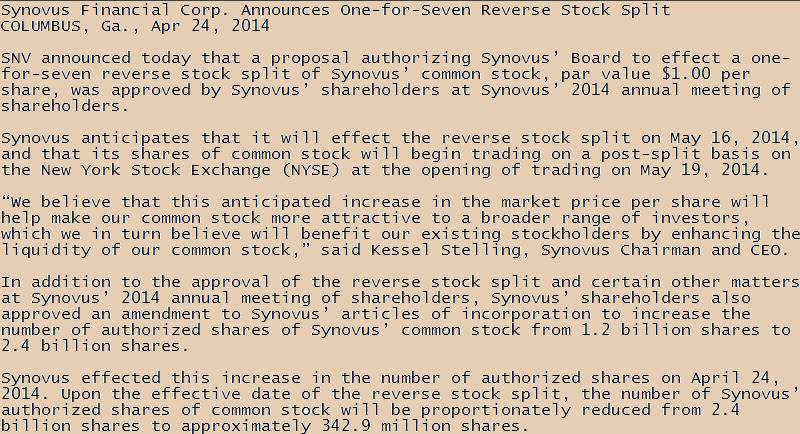

A

reverse split is usually considered a death knell for pink sheet

stocks and since Synovus isn't one, this has some merit. A

reverse split at these prices would bring the share value up to over

$21.00 and that I think would definitely generate more interest with

institutional as well as individual investors.

For someone looking to hold long term, SNV is a decent prospect. I think HBAN is another one worth considering as well.

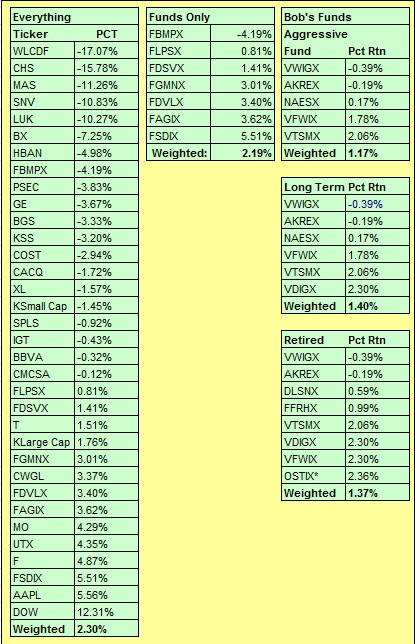

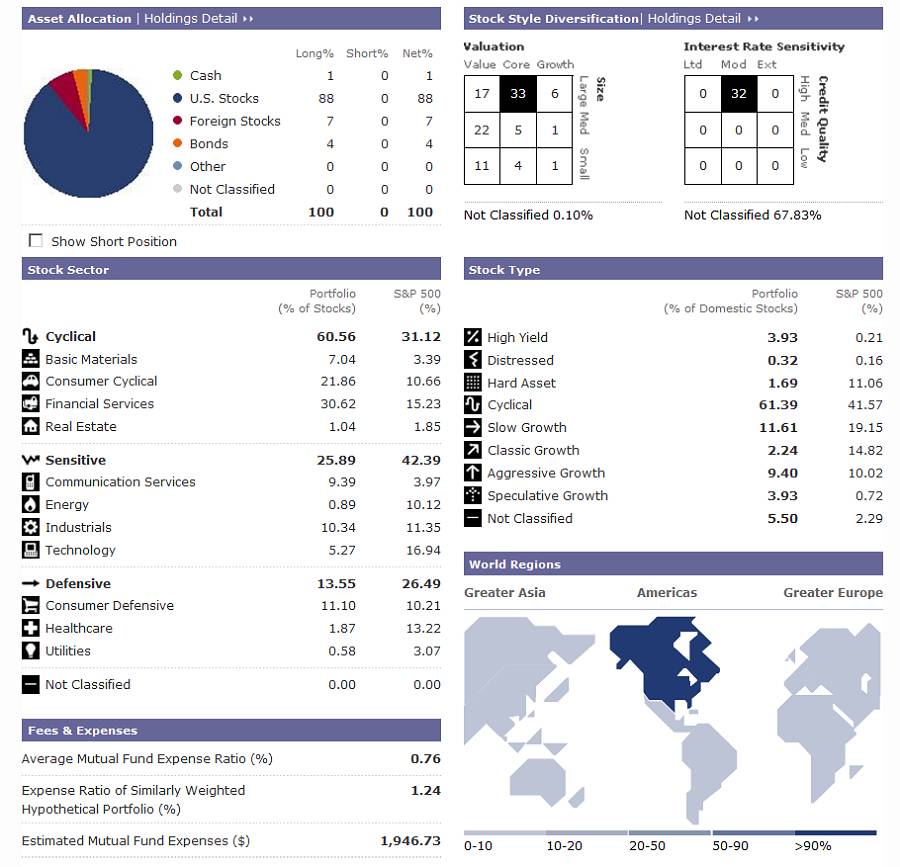

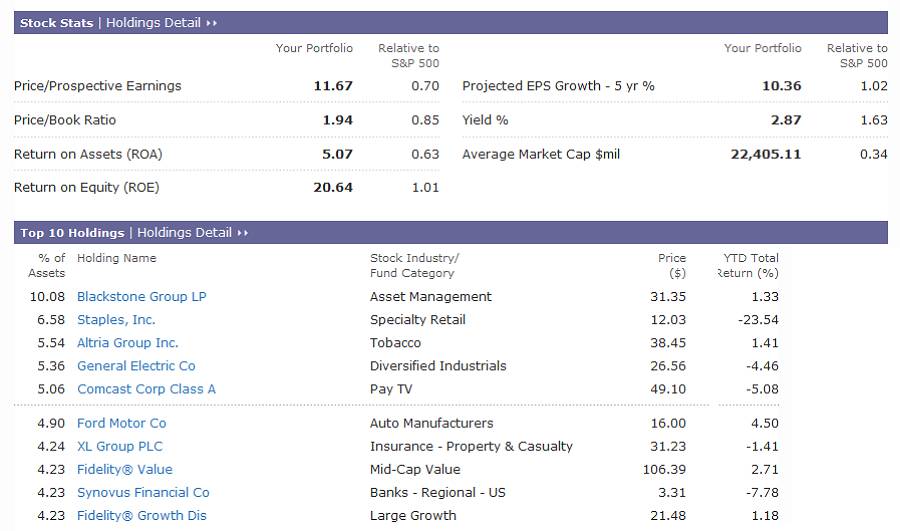

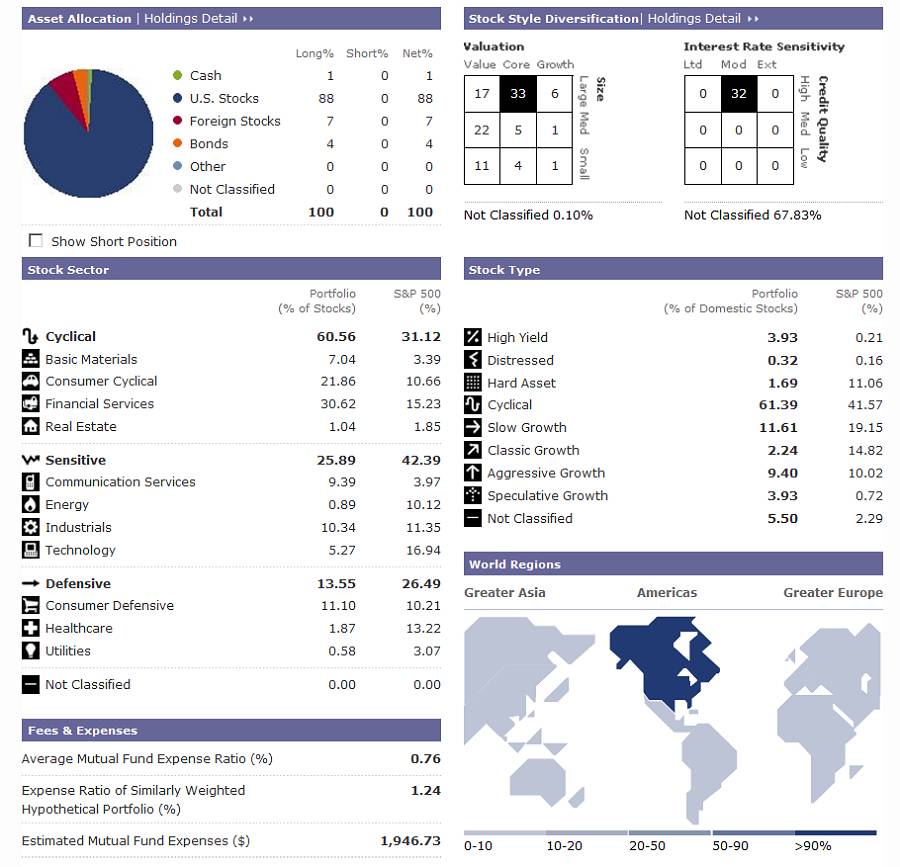

Morningstar's Instant X-Ray

It

is good practice to periodically use a service like Morningstar's

Instant X-Ray to evaluate your portfolio allocation. I do this at

least twice a year.

I am fine with this allocation, in fact I am

a bit surprised as to how good it looks as compared to where I would

want it to be.

Blackstone

and Staples are overweight because I bought a bunch of shares on the

cheap a week or so ago, and am hoping to off-load them for a profit at

a later date. I would say that if I were to play Cramer's 'Are

You Diversified', I would get a pass.

On the other hand,

Warren Buffet has been quoted as saying that diversification is a way

of protecting those who don't know what they are doing, from doing too

much damage to themselves and their portfolios. I think there is

some truth to that.

Stock Types - My Opinion

High

Yield - If you are going for yield, why not. If it is

quality and in a tax sheltered account, so much the better.

Distressed - I stay away from them unless the distress is the result of a knee-jerk reaction.

Hard Asset - Don't particularly care for the sector, unless it is for speculation.

Cyclical - Overweight, if you think you are in an uptrend, albeit a torturous one.

Slow Growth - Not so much while in the accumulation phase.

Classic Growth - See 'Slow Growth'

Aggressive Growth - An indexed allocation and few if any high fliers with stratospheric PE's.

Speculative Growth - Of course. After all, I'm from Nevada.

Not Classified - Of Course - see 'Speculative Growth.'

Stock Sectors - My Opinion

Basic Materials - Absolutely, if you think the economy is expanding

Consumer Cyclical - Absolutely - see 'Basic Materials'

Financial Services - Absolutely - see 'Basic Materials'

Real Estate - Underweight. I think most of the money has already been made in this sector.

Communication Services - Sightly overweight and the reason should be obvious.

Energy - Underweight, considering this administration's energy policy.

Industrials - Equal weight.

Technology - Underweight. With the exception of Apple, I'm lousy at technology picks.

Consumer Defensive - Equal weight for some stability.

Health Care - Underweight., considering my opinions on TeleprompterCare and what it is doing to the most important participants in the sector.

Utilities - Underweight - see 'Energy'

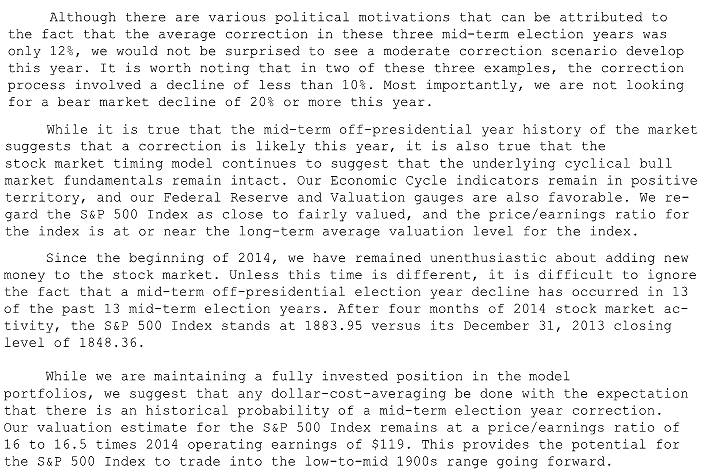

And......the latest Capitalist Pigs News Letter

A Dog's Life

|