'Can someone tell me on which subjects Mrs Clinton and Jeb Bush disagree - I am at something of a loss to discern a difference.'

-gdraper133

A Cooper's hawk lands in the yard.

| April - May, 2015 'Can someone tell me on which subjects Mrs Clinton and Jeb Bush disagree - I am at something of a loss to discern a difference.' -gdraper133  A Cooper's hawk lands in the yard. |

|

The Professional Opinion - DJIA 17840.52  No problems on the home front. Stay fully invested, which is the usual advice. |

Not a bad way to end the month! I never thought Kohls would end up being the winner. Alibaba......disappointed in that and am unsure if this should still be a hold. |

So what is the teleprompter up to this time around? It wouldn't have anything to do with a back door deal to arm Iran would it? Between the teleprompter trying to weaponize Iran and Mrs Clinton selling a portion of our uranium assets to Russia to further benefit the Foundation, how does one make the distinction between treasonous and really bad behavior? I don't know if we are looking at a Manchurian candidate here or just looking at a really &$*#&^ stupid one. Anyway, returns for the quarter are looking quite nice, no thanks to the teleprompter, and we might make some nice gains for the rest of the year in spite of the teleprompter. Lets hope Apple has a blow-out quarter!  |

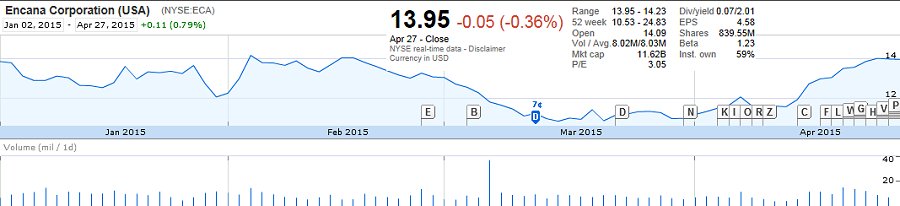

Western Lithium - Organoclay.............What's That?  While I do not yet think that this is a steaming pile of doggie do-do, I am no longer a long term holder of Western Lithium. It's good for some short term trading if you are looking for a 5-10% easy turnaround but other than that, I'd stay away from it. Rig counts are down, layoff's in the industry are up and I highly doubt will be any lucrative Organoclay contracts in the near future. Instead of Western Lithium, I have a better idea: Encana (ECA)   Whilst traveling in the rarefied atmosphere that is the first class cabin, one on occasion has the opportunity to meet some interesting people. On this particular day, that interesting person was in the upper echelons of of Encana and OGC concern and amazingly enough, he had been to many of the same places I have had the pleasure of visiting, Fort McMurray, Canada included. Power Production and OGC have a lot in common and I learned some interesting things about Encana, which caused me to do some further research. I came away deciding that the company would make a reasonably prudent addition to the personal portfolio, pairing up nicely with WMB, another fairly recent addition. MDR - McDermott International, Hanging in There  MDR has turned out to be a decent trading stock and if it stays over 5, it may be worth hanging onto a chunk as a longer term hold. A couple new contracts here and there, a partnership with GE......it is starting to look reasonably attractive as something other than a trading vehicle. FXCM - Still have a Few Shares  FXCM looks to me to be a decent candidate for a nice spike in the share price if and when they pay off another chunk of their loan From Leucadia. Two and change, at least it can't go much lower. I've been adding a few more shares here and there at these prices. Opinions on this company are pretty much black or white. Either people think the company is realistically worth only pennies a share and others think a return to the $5.00 range in the not too distant future is not unrealistic. I'd be happy with $3.00 in change in the not too distant future. I had to chuckle at a number of recent news items in which Forex was featured as a sucker's game for 99% of those who wish to give it a try. Oh really???? Only now people are starting to figure this out???? I think they fail to make the distinction between investing in a Forex Trading Company and trading in the Forex Markets. It is a big distinction. Another fine media example of 'Ready, Fire, Aim.' GoPro (GPRO) - Back in for the Longer Haul   I originally picked up GoPro to make a quick buck and in retrospect, I think that was short sighted. I also didn't realize the closeness of the relationship between Apple and GoPro, which I think is a positive.  GoPro cameras are sold in the Apple store as well. I think this is worth hanging onto for the longer haul and ended up buying shares during the latest market slump. And last but not least, the Capitalist Pigs latest Monthly Newsletter. Deflation and what is it, is the subject of the February newsletter and the topic is a good one. One thing......don't pay attention to the charts if they are confusing (I am not a chartist so sometimes they are). Ignore the charts and read the text, which makes a lot more sense to me than the charts often do.  Back in Boston  Servers  The Teleprompter |