Personal

Portfolio

|

With all the drivel our favorite teleprompter has been

spewing about the wonderful things he has done for the energy sector,

one would expect gasoline prices to be coming down.

In reality,

the teleprompter has done as much to promote sound energy policies as

Al Gore has accomplished in creating the Internet.

Speaking

of energy, one might take a look at Chesapeake Energy this month.

Trading at half the price of its 52 week high, I think there's

possibility there .....provided the CEO and his reported 'conflict of

interest' issues are only smoke, and not fire.

|

|

Personal Portfolio

HBAN

remains a favorite of mine and I've got lots of shares :) Oh, and

they quadrupled their dividend as well to four cents :)

If only Bank of America was performing as well..........

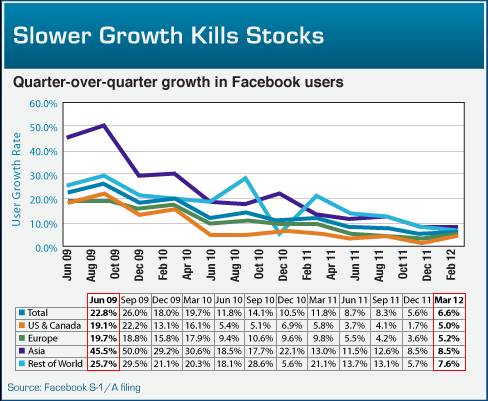

So what about Facebook?

Personally,

I would stay away from this one and I have nothing to do with it

anyway. Another thing to consider is the economy. As

the economy improves and particularly if we get the teleprompter

voted out of office, more people will be going to work. More

people working means less time on Facebook. Less time on Facebook

means less clicking on advertising links.

I could never figure that one out anyway. I go out of my way not to click on advertising links. I go to places for information, not their wonderful ads.

Brave New World, I guess....

Electronic Arts Revisited (Groan)

So

what did Electronic Arts do as soon as I bought it? Declined in

price from the original purchase at 16.60 a share, of course.

I

got back on the horn to my sister the other day and asked her is she

was still enthusiastic about the stock, particularly after it made the

news as the worst tech company around for management leadership

and other fairly important items. She said she was, and that

gamers are a particularly vocal crowd and that EA is listening to them.

So, I will continue to hold.

TIPS - What are they Anyway?

I don't know all that much about TIPS and the like beyond layman's knowledge of the subject but maybe this will help out:

TIPS,

otherwise known as Treasury Inflation Protected Securities are pieces

of paper you can buy which hedge you against losing the purchasing

power of your dollars due to the effects of inflation over time.

People

who believe inflation is going to ramp up in a big way in the future

use TIPS and hard commodities like gold to protect themselves.

Gold in particular is quite popular these days among the fear mongers.

5

and 10 year tips last month turned yield-negative, which means people

have been bidding up the price they pay for TIPS to the point that the

yield on the paper is in the minus.

In other words, imagine

paying $20.00 for a bond that yields -.5%. What this basically

means is that you are so scared of inflation and the world at large

that you are willing to lose some money in order not to lose more.

People

like Suze and a bunch of others came out in 2011 saying that 2012 was

going in flames. Today they are still saying it but have toned the

rhetoric down, saying it still could be pretty bad in 2012 but in 2013,

2014 it's sure disaster.

Curiously enough, they are all either pandering gold, term life insurance, annuities and living trusts.

And coincidentally I'm sure....they all happen to know each other and they probably all watch CNN and MSNBC as well.

To

my way of thinking, if you look at the earnings multiples currently

priced into the overall market versus where they would be during normal

times, you're still looking at lots of bargains out there even

after the considerable run-ups we've experienced.

Equity

funds even now are still experiencing large outflows into fixed income

securities. This of course is driving yields on any bonds issued

by the government into the ground. People who depend on CD's, govt

bonds and the like are finding it hard to live on the fraction of

a percent interest many of these pay.

This leaves them with

three other options - invest in higher yielding junk bonds, putting NAV

at more risk or investing in stocks paying a dividend, putting share

price and dividend yield at more risk. The third is buying insurance

contracts, otherwise known as annuities.

Either way the

extremely low rates of interest are in the end going to have the effect

of driving more people into stocks for growth and yield. And...if

you happen to be holding quality equities now, you could end up in the

catbird seat further on down the road.

If you're maxing out

your retirement vehicles - Roths, 403B's, 401k's and the like and

buying quality in them....that's even better.

Annaly Capital Management, my favorite REIT has come out with their Q1 Commentary:

Annaly Commentary

This

is an example of NAV (Net Asset Value) fluctuation in return for

yield. For some people, preservation of NAV is the most

important thing and for them, this would be the wrong

type of investment. For me, I'm not so concerned because

this is a decent company and it's share price will fluctuate and.....it

has a great yield.

Holding a REIT like this doesn't

mean you have to hold it forever though, as long as you hold it on the

distribution date for the dividends. I may trade this several

times a year when something attractive comes along........like when NLY

is trading high and BAC gets hammered. I'm currently holding a

lot of BAC and plan on selling it back in the near future for a profit

and more shares of NLY. Works out well most of the time.

Chesapeake - The Victim of a Hit Piece and Possible Buying Opportunity?

It all started out with this.

Chesapeake rebuffed the accusations, basically saying that the detractor did not know what he was talking about.

Of course, everyone else piled on, launching investigations of possible breaches of fiduciary duty.

A very lengthy response was issued by Chesapeake counsel and it can be found on their web page.

I think Reuters did a hit piece.

I'm

sure all this is very distracting and it led to indications of an early

termination of the founder's well-participation plan.

All that aside, it appears the natural gas decline is bottoming out and Chesapeake is closely tied to nat-gas prices.

Trading

at about 50% of its 52 week high, this sure looks tempting but if

anything it may go lower because Kinder Morgan is working on putting a

couple more large natgas pipelines into service, and all of it headed

to the east coast.

And, some companies recover well from the 'appearance' of impropriety and others don't.

| THE PROPHET WATCH

What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here

Financial Analyst - NOT

Soothsayer - NOT

Bearer of Practical Financial Advice - Occasional

Man's Worst Nightmare - Maybe......

Having to listen to annuity pitches interspersed with vitamin infomercials could be worse.

|

Let's keep track of just how well this PITA's 'predictions' pan out for the rest of the year.

| 2012 |

Predicted |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| Gold |

$2,000.00 |

1736.7 |

1716.28 |

1671.9 |

1664.2 |

|

|

|

|

|

|

|

|

| Recession |

60%

Chance |

Nope! |

Nope! |

Nope! |

Nope! |

|

|

|

|

|

|

|

|

| TIPS

Current 5yr Yield |

Home

Run - Maybe |

0.95% |

0.90% |

-.126% |

.125 |

|

|

|

|

|

|

|

|

San Simeon, California at the Best Western

|

|

|