Bottom Fishing - Looking a Few Opportunities for Yield

IGT got suitably crushed when the company did not make their earnings estimates and I think that was way overblown.

At twelve dollars and change, and a PE of 13.47, the current yield of over 3.5% looks very attractive. I'm back in.

Petmed

Express I've held off and on over the past couple years. For a

small company, it has been paying a reliable dividend and 5% is nothing

to sneeze at.

I got back in at $12.90 and plan on holding for the longer term.

Staples

got a major haircut after another poor earnings season. Coupled

with plans to close a bunch of bricks and mortar stores, the stock took

a nosedive. That's ok with me though, because most of my original

shares were purchased in the low 11's anyway. Staples is only

behind Amazon when it comes to on line retailing. I think longer

term, the company will do fine. In the interim a yield of 4%

reinvested in new shares of course, is not an unattractive place

to have some money invested.

Staples

is one of my favorites for swing-trading and the last month has been a

profitable one with all the volatility going on. I have a core

holding in Staples. Believe it or not, it is second only to

Amazon when it comes to on-line retailing.

3D Systems I bought

for a short time in the thirties and sold out in the 50's. The

stock had quite a run after that, as well as a precipitous fall.

At 46 and change, the company still sports a PE of over 100.

Of the 3D printing companies currently occupying the space,

I think DDD is the best of the bunch and just about the only one

that actually earns a profit. I'm thinking about taking a

position in DDD again and was surprised to see the partnership with

Staples, albeit a small one but, two stores is a starting point.

On the Speculative Side....

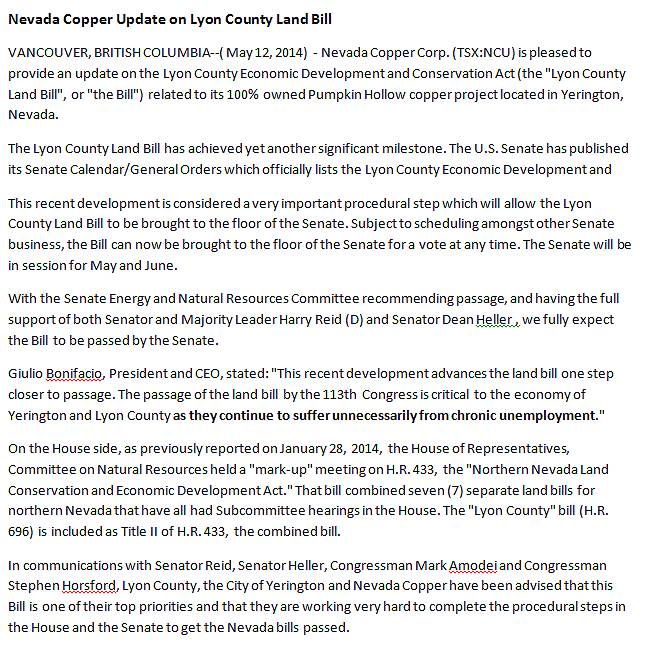

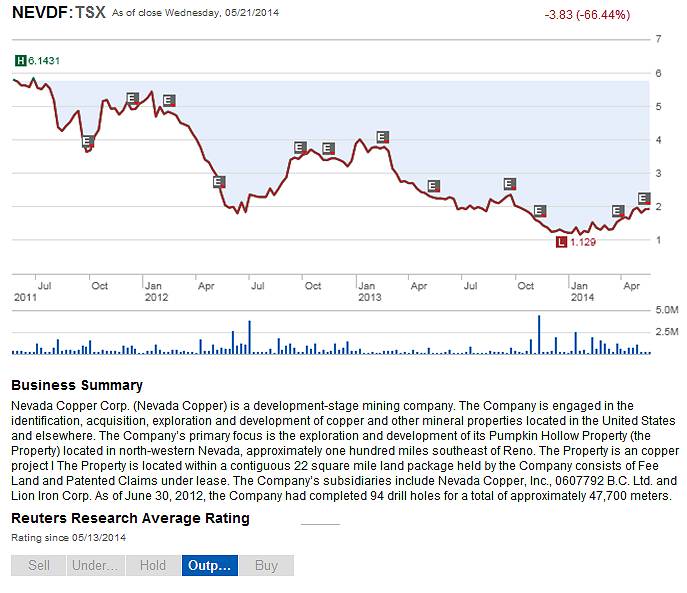

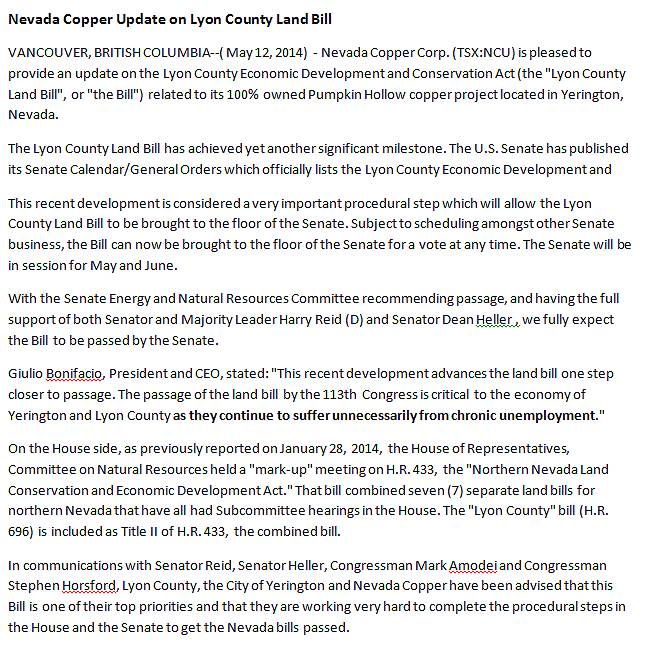

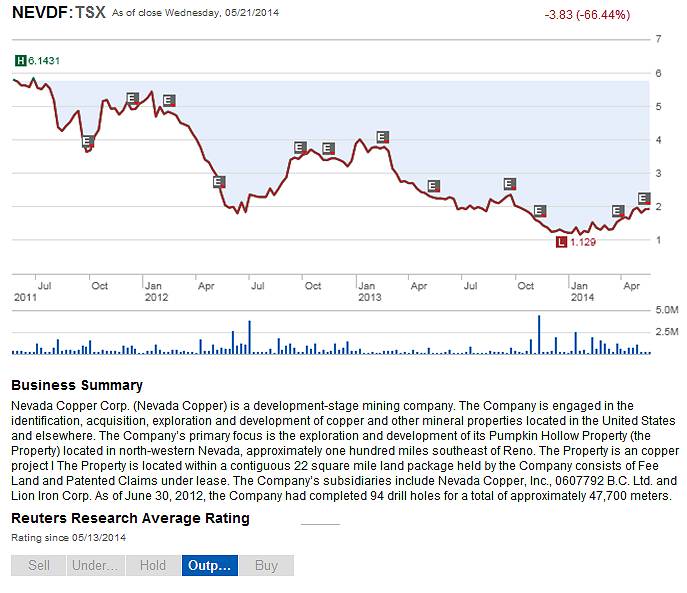

Nevada

Copper is about as speculative as I'd ever care to get. We'll see

if Harry can actually do something useful for the state, Lyon county in

particular and help get the land bill passed. This is the

most encouraging bit of news I've seen. Locally, there have

several radio ads extolling the virtues of getting the Pumpkin Hollow

mine up and running.

Based on this last news release,

I would say Nevada Copper is worth a small speculation.

Bear in mind that any dollars invested in a company of this

sort..............taking those dollars, throwing them up in the air on

a windy day.........can just as often achieve the same results.

And Reuters has an 'Outperform' rating on the stock..................a Pink Sheet Penny Stock...............really??

Synovus Financial (SNV) after the Reverse Split

...... an 11.87% return so far after the reverse split........not bad!!!!

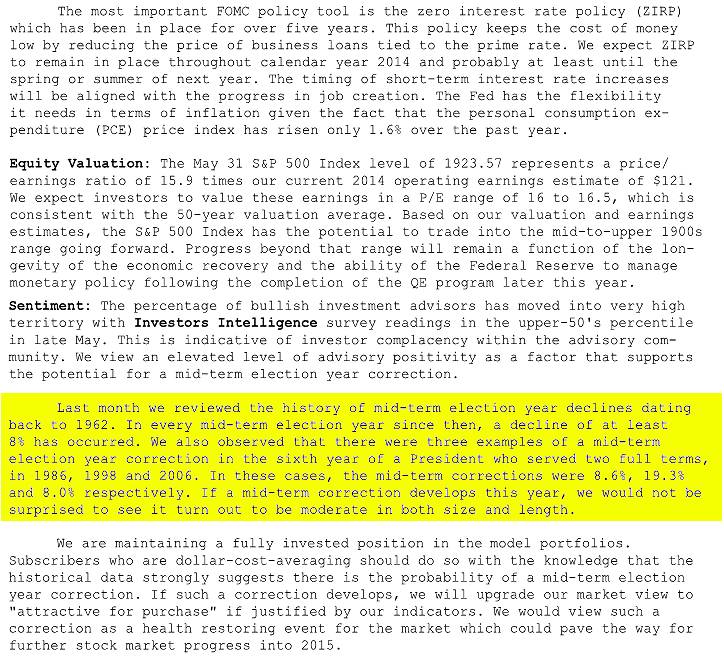

And June......the latest Capitalist Pigs News Letter

This would be funnier if it wasn't so true.

|