Personal

Portfolio

A lot of red this month. Looks to me like a good time to go on an extended vacation.

|

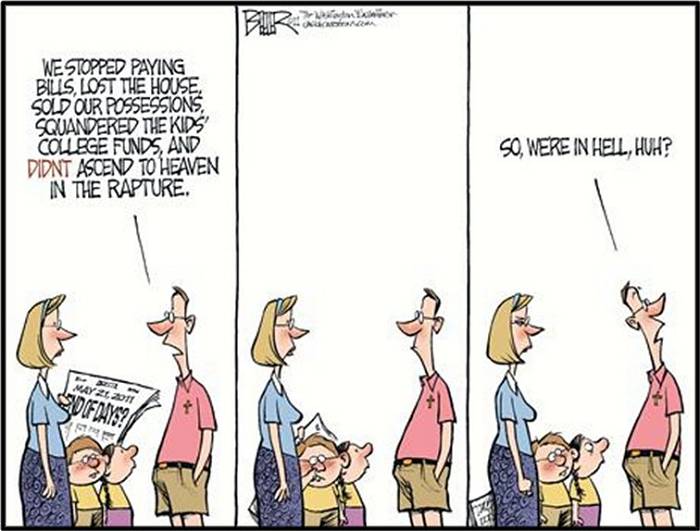

Only in America, Aye?

Selling assets for in return for promise of salvation

strikes me as one of the stupider ways to plan for retirement.

But this is America and you can be as stupid as you like.

Witness electing teleprompters.

|

|

Personal Portfolio (on to more Earthly matters):

I

think it would be beneficial to diversify out a bit into a quality

Canadian company, given the state of the US dollar and the

current government plan to spend us into oblivion.

Potash (POT) fills the bill and it is currently at an attractive price.

This is a long term hold.

MGM

is a more speculative stock but it has significant expansion

overseas. I've traded this one a few times and bought it again

during the pull back. I think I'll hang on to this one a while as

well.

Time to get back into Energy again?

If

you think it's worth sticking your toes in the energy waters

again, PBR is worth a look. It's cheap by PE standards,

pays a dividend and it does move.

I sold my energy

positions a couple months ago because I thought I was looking at a

bubble. The sector did deflate and I think it's worth

picking up a stock or two.

The potential downside is that

this is an ADR, an American Depository Receipt for a foreign stock.

There are added currency and political risks associated with an

ADR.

However, considering what is going on with the joke

we call a government........it might be well worth diversifying

out of the country once more.

Terra Nitrogen is a company that I think looks attractive. Low PE, low volitility, decent yield.

Fixed Index Annuities

For radio listeners such as I, there should be an equivalent to Annoyances.org for venting about radio programming.

There

are probably at least a dozen infomercials currently running, espousing

the great benefits of fixed index annuities and statistics show that

the fear factor, ignorance and slick marketing are sucking

billions of dollars out of US citizens.

They all start out

telling you that the products they sell are guaranteed to never lose

value and go on to say while many suffered significant losses during

2008-2009, none of their clients ever lost a lost a penny.

These

'advisers' continue by cautioning that the investment world is far

too complex and dangerous for an average citizen with a moderately

functioning brain to take part in by himself. He needs an experienced

'adviser' guiding him to financial bliss. Guiding him to an

under performing insurance contract would be a more accurate

description of the services these 'advisers' render.

These

clients who 'never lost a penny', is that really true? If it is

true, it would seem to me I would be giving up something in return for

a guarantee of safety.

The answer is yes and yes.

Insurance

companies don't sell annuities and expect to lose money in the

process. They are in business to make a buck, not to ensure your

financial freedom.

How do they accomplish this and promise at the same time that you will never lose your money?

Fairly Easily.

1. Guarantee you a rate of return which also guarantees the insurance company will return a profit.

An

example might be a bond, where the insurance company buys a bond

yielding 6% with your pooled money. They pay you a guaranteed

3.875% and keep the remaining 2.125% for themselves.

Not a bad deal for the insurance company. Not such a good deal for you, when you could have bought that bond yourself.

2. Lure you in with 'Up Front' Bonuses.

'We'll give your account a 'bonus' of $500.00 if you invest $10,000 with us.'

That

doesn't sound so bad if you don't look at the fine print. If you

do look at the fine print, you will probably find that your guaranteed

3.875% shrunk to 3.75% percent to account for the 'bonus'.

3. The insurance company keeps any dividends.

Yup,

that's right. Say the insurance company chooses to invest your dollars

in the S&P 500 index and quarterly dividend payments come

around. They keep any dividends (which can be substantial) and

pay you the promised 3.875%.

You could have kept your money and your dividends if you chose to invest the money yourself.

4. The Fixed Index annuity pays no compound interest.

Believe

it or not, this is also true. If you invest $10,000 dollars in a

fixed index annuity contract, you are paid interest on the original

$10,000 only.

This means that if you earn $100.00 worth

of interest, that money is for all intents and purposes dead

money. Your account might now be worth $10,100 dollars, but you

are only being paid interest on the original invested amount.

Not a bad deal for the insurance company, but a rather lousy deal for you.

5. The Fixed Index Annuity ties up your money for long periods of time.

That

doesn't sound so bad, after all it is money for retirement.

Suppose however, you live in a tornado prone area and yesterday your

house was reduced to a pile of rubble, your car is now residing under

toppled oak tree, your job is gone because the business is

gone........what do you do?

or........

Suppose

you think you are going to get raptured up and need cash to buy rapture

billboards and signs for park benches. You also need

rapture insurance, guaranteeing care for your pets should you get

whisked up into outer space.

If you're a little light on emergency cash but you do have money in annuities, you can tap into that piggy bank, right?

Sure.

But,

if that money is still under the contractual agreement of an

annuity, you can pay big $$ in surrender fees to the insurance

company to get access to the cash because you are in effect breaking a

contract.

Worse than that would be raiding an annuity inside a

retirement account and if you are not yet 59 1/2, Uncle Sam is just

going to love you for the substantial contribution you made to the IRS.

I

would say those are five major reasons not to purchase fixed index

annuities. Throw in proven sub-par performance and higher costs in comparison to

investing in conventional investment vehicles, is that guarantee of

safety all it's cracked up to be?

I think not.

What Else.......

Here's the portfolio allocations:

| Sector |

Apr |

May |

June |

| Banks: |

18.98% |

17.97% |

17.02% |

| Investing Co's |

2.71% |

2.73% |

2.78% |

| Telecom / Inet |

12.37% |

12.36% |

10.22% |

| Manufacturing |

12.61% |

12.78% |

12.15% |

| Food / Sin |

10.31% |

8.42% |

9.01% |

| Insurance |

6.10% |

5.92% |

5.91% |

| Real Estate |

5.42% |

5.44% |

5.93% |

| Tech |

4.60% |

7.24% |

6.81% |

| MF -

G&I |

7.23% |

7.15% |

7.44% |

| MF - Value |

7.18% |

7.56% |

6.51% |

| MF - Small Cap |

4.51% |

4.94% |

3.93% |

| MF-Large Cap |

4.36% |

4.38% |

4.38% |

| Other |

@ 4% |

@3% |

@8% |

I took a large chunk of BGS foods off the table - impressive profits there, and moved more to tech.

Banks are clearly the drag but I'm holding pat on what I have.

How does that saying go?

"Fool me once, shame on you. Fool me twice, shame on .....who?"

"Fool me three times, I might as well shoot myself because I'm a complete idiot."

Bad Hair Day?

| |