Personal

Portfolio

|

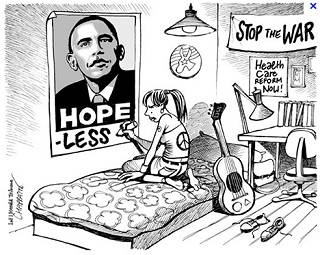

The supreme court in a truly bizarre move, failed to

drive a stake through the heart of teleprompter care. If the

republican party ever needed a unifying theme for the next six months,

this is it. On the other hand since this thing is now a tax

instead of commerce let's see the libs go all out in trying

to levy more taxes in the months prior to the elections. I think

it would be guaranteed to help them with their re-election campaigns.

|

|

Personal Opinion

Not

a lot to talk about this month although it's hard not to notice that

quality dividend paying stocks are doing quite well and I think they

are symptomatic of the times we are living in. By the way,

purchase an annuity and forget the dividend.

I didn't do much at

all, other than to do some buying in commodities when the markets

regularly tanked on euro news, and then sell into the latest upbeat

rumors. I traded Amazon a couple times using the same methodology and

in the end, came out with a 15+% gain for the year so far.

Boy, do we need a change in leadership...............

Electronic Arts Revisited for the Fourth Month (Still Groaning)

EA continues to fully live up to my lowest expectations. Of course, the market's not helping much either.

This is one you do not want to chase down, averaging lower and lower.

It's also one that usually manages a miraculous turnaround just about the time you decide to sell.

My take......wait an see if a stake gets driven through the heart of obamacare.

If

it does, a lot of uncertainty will leave the market and the

relief may manifest itself by purchasing those video games people

wanted but couldn't justify at the time.

If that piece of

&&*# legislation is ruled constitutional, people will

probably buy more games anyway, along with massive quantities of adult

beverages as the first line of defense against the tax hikes coming

down the road in 2013

It's a win-win situation either way...............I think.................

.

2013 -The Coming Telepromptolypse of Economy Killing Taxes - Do you have a backup plan?

One

thing I would be thinking about is having a backup plan as it pertains

to financial assets in this economy. The worst case scenario

would be another 4 years of the teleprompter , telepromptercare gets

upheld and tax hell is allowed to descend in 2013. It's not that

far away and if I were you, I would be at least inventorying what you

have and looking at it from the perspective of how those assets would

hold up in a rapidly deteriorating economy.

The calculations

are out and if our government behaves as is par for the course for

elected officials anymore, doing nothing to fix the coming tax hell

will result in a loss of 3.5-4.5% GDP.

In other words, it

will be an economy killer and those who have been persistently crying

wolf may finally get it right.

I for the most

part am a glass is half full sort of person but it if nothing

good happens over these next six months, I will be all for

preservation of capital.

Question from JimOCYA: What do you think is Better - Buying and Selling at Market or a Fixed Price?

Wow! I think this must make four people who actually peruse these pages on occasion. I guess I'd better answer it.

I

personally buy and sell most stocks at market. I don't really

care if I could have bought for a few cents cheaper or sold for a

couple cents more. I care more about buying when I want to buy and

selling when I want to sell.

Now if you are dealing with small orders, price becomes more important and I can see setting limit orders in some cases.

The one major exception to this is the volatile commodity stocks, oil in particular.

I

like to trade in and out of HollyFrontier and Suncor and usually always

set a limit price on the sell order. The buy order.....it

depends.

With stocks like these, what you see as the bid price

and what you get at market can differ substantially. It is best to

consider limit orders on the more volatile stocks.

| THE PROPHET WATCH

What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here

Financial Analyst - NOT

Soothsayer - NOT

Bearer of Practical Financial Advice - Occasional

Man's Worst Nightmare - Maybe......

Having to listen to annuity pitches interspersed with vitamin infomercials could be worse.

|

Let's keep track of just how well this PITA's 'predictions' pan out for the rest of the year.

| 2012 |

Predicted |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| Gold |

$2,000.00 |

1736.7 |

1716.28 |

1671.9 |

1664.2 |

1616.9 |

1604.2 |

|

|

|

|

|

|

| Recession |

60%

Chance |

Nope! |

Nope! |

Nope! |

Nope! |

Nope! |

Nope! |

|

|

|

|

|

|

| TIPS

Current 5yr Yield |

Home

Run - Maybe |

0.95% |

0.90% |

-.126% |

.125% |

-1.03% |

-1.00% |

|

|

|

|

|

|

June comment: Boy, Suze's TIPS suggestion is working out

real well, isn't it. A negative yield means people are actually

buying these things at a loss in return for safety. If I was in

Euroland, that might make some sense. That gold play is working

out really well too, isn't it.

An enhanced photo of a Swainsons (?) Hawk - Stillwater Preserve - Fallon, NV.

|

|

|