'The odds of making it to a successful retirement usually depend on whether or not you are still married to your first wife.'

~Unknown

Bandon, Oregon

| November - December, 2014 'The odds of making it to a successful retirement usually depend on whether or not you are still married to your first wife.' ~Unknown  Bandon, Oregon |

|

The Professional Opinion - Taking a Subscription Vacation for a couple months. |

A pretty decent month, all in all. The market is doing well despite the latest panic dejour, and that would be Ebola. It is also like unfortunately that Canada's liberal-progressive attitude towards muslims with jihadist leanings is coming home to bite them. Better learning the hard way, than not at all. It remains to see which path Canada chooses to follow. Hopefully they don't have a teleprompters in charge as well. They probably do though, considering that they are Canada. |

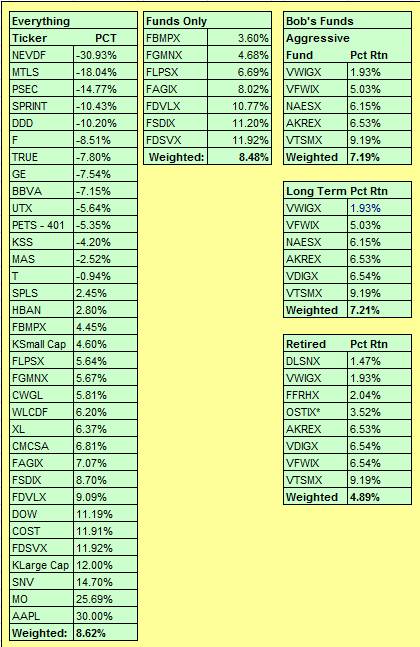

Political Correctness run amuck. Earnings all in all, have been pretty good this quarter. Valuations of the major indices overall are still within reasonable limits, although some equities are starting to get rather pricey when it comes to their individual PE's. Half-way through the year is a good time to do some rebalancing of the portfolio if necessary and for me it was. Some nice gains on Staples - finally. Later on this month we will see if the Western Lithium ship has come in - this will be worth watching. Me, I wouldn't be surprised if the start-up gets delayed again but who knows... we could be in for a nice surprise.  |

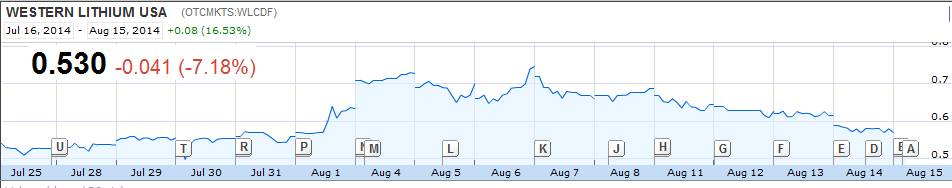

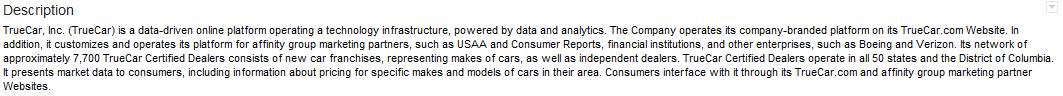

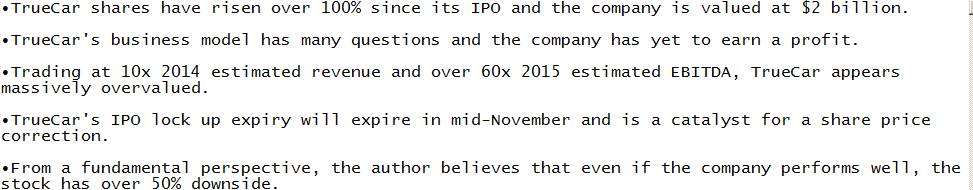

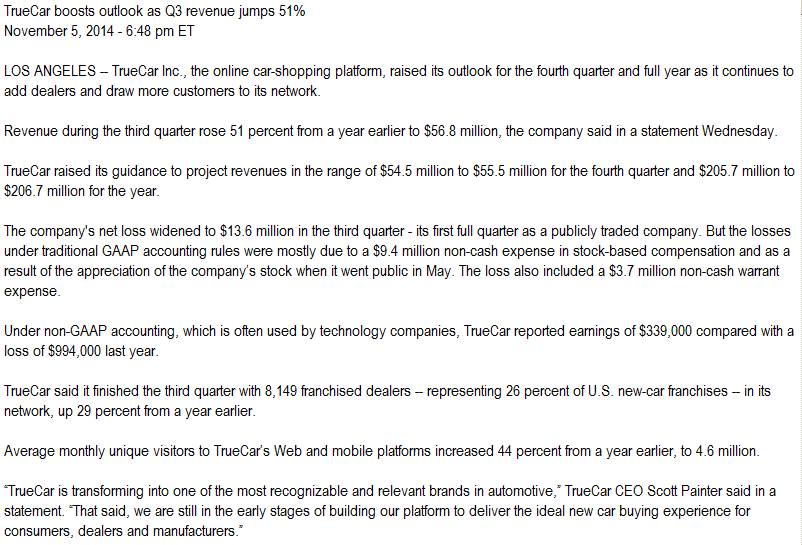

Western Lithium - Organo Clay at the end of the Month?.............Not  That last run-up to .75 and change was a real money maker and I was not expecting that. I took some profits and ran. I am thinking that should the price drop down a bit further before any positive news, that that would be a nice little chunk of change for the retirement portfolio. If not, well, I sold half the position at a very nice price and any losses would be minimal.  The stock price has held up very well, despite having produced nothing to date. However, there is at least one contract supposedly signed for Organoclay. Commissioning is still reportedly in the works. I suspect the stock price will stay within a fairly narrow trading range until there is proof that this Start-Up has turned into a real production facility. 3D Systems (DDD)  3D has been a money maker for me in the past but I think there is far too much risk involved with this company, especially after the latest quarterly earnings announcement.  Their last earnings announcement was a real stinker and fortunately for me, I sold all the day before. True Car (True) a Recent IPO   If you like trading on volatility, try True Car. This to me is not an investment, it is an off and on trading opportunity and you need a strong stomach and patience unless you get lucky. I've been lucky a few times, other times it was to the point of wondering whether or not I got myself stuck in a bear trap. From the message boards:  And this:  I'm currently holding some shares that I bought during the Ebola scare and am hoping to sell them for a 5% plus return over the next week or two. I would not bet the farm on this, but there is some money to be made here if you buy in at the right price. A Couple Weeks Later:  I ended up buying this back prior to their earnings announcement and of course it is currently trading lower than what I picked it up at, but I'm starting to think that this is worth hanging on to for a while. Here are the Q3 Earnings Hilights - Look pretty good to me. And last but not least, the Capitalist Pigs latest Monthy Newsletter.  Bandon, Oregon Sunset |