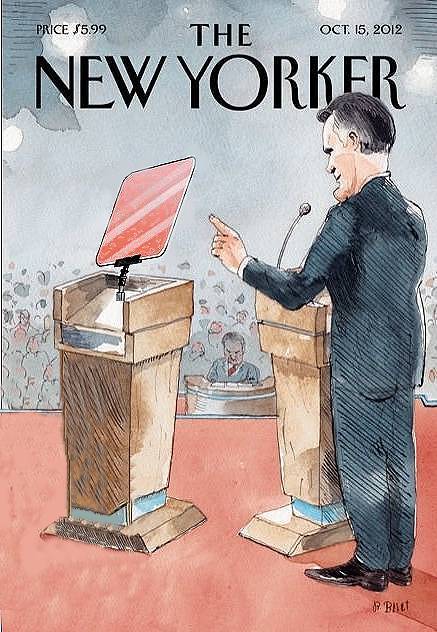

| November, 2012 'Mr. President, you’re entitled to your own house and your own airplane, but not your own facts.' 'I’ve been in business for 25 years. I have no idea what you’re talking about. Maybe I need to get a new accountant, but the idea you get a break for shipping jobs overseas, is simply not the case.' ~ Mitt Romney - First Presidential Debate |

|

The Professional Opinion - DJ 13447.13 After a year of taking a subscription vacation, I decided to renew the subscription. I don't use his portfolios but do follow his sentiment. I was frankly surprised at this months newsletter. The upshot of it is that Bob has taken much of the risk out of the portfolios, selling RYDEX (QQQ) and going with an S&P 500 index fund as an example. On the bond side he sold most of the high yielding stuff and went into funds with shorter durations. He doubled his GNMA position:  I'd been doing this myself for the last six months, moving more into G&I stocks and out of pure growth. With the current dysfunction going on in government, I decided another opinion would be helpful:  Buy Recommendations None. Everything is rated as a hold, which is usually the case.  Cooper-s Hawk - Gotta love those Canon SX Super Zooms |

|  Earnings season is upon us again. The general flavor seems to be that while most companies are reporting decent earnings now, the consensus going forward calls for slower growth due to uncertainty in the markets, uncertainty about taxation, uncertainty about the teleprompter, uncertainty about the fiscal cliff............. ...................uncertainty everywhere. That is a heck of a way to run an economy and a country and looking at recent polling I would say that for the second time, 'Change is Upon Us'. We do however, have to remember to get out and vote. Let's see if we can make a lasting, permanent change to these uncertain times.  |

What the Heck is a Mondelez International Inc (MDLZ)? Kraft Foods Inc has completed the previously announced spin-off of Kraft Foods Group, Inc and changed the name to Mondelez International. It will trade on The NASDAQ under the ticker symbol MDLZ. Kraft Foods Group will trade on The NASDAQ Global Select Market under the ticker symbol KRFT. This is one of those instances in which Kraft thinks value can be unlocked by spinning off it's junk foods division. Kraft remains a favorite among investors seeking dividends. Mondelez is being snapped up by those seeking growth. Me, I think Mondelez presents the best opportunity of the two so I picked some up this month. However:  I hope this trend reverses itself. Blackstone (BX) and Jefferies (JEF) - Long Term Gold? I think so, or maybe I'm being just plain stubborn.....   I picked up Blackstone a year or so after it took part of itself public and have been adding to it since. The company has been buying the heck out of private and commercial properties over the last year and I think is poised to move significantly higher if we retire the teleprompter for good this election season. One of the issues with Blackstone insofar as analysts are concerned, is a good way to properly analyze this manager of private equity. I like what I read about Blackstone and continue to hold.   Jefferies was unknown to me until a certain ratings firm tanked the stock using false accusations of overexposure to the Euro Crisis. I really like the fight that Richard Handler, the CEO put up after the alleged overexposure. He seemed to me to be an honest and stand-up guy and I was impressed. I've been picking up more of Jefferies on the dips as well. Strong and honest leadership make this a stock that I think will be a rewarding hold when the economy normalizes. Selling Access  Something for you social media fans to think about.  How would you like to wake up to a puss like that every morning. Me, I think if she's trying to raise $$ for self-sterilization, I might kick in a few quarters. An Email!.....I think that makes 3..... 'Hi Dan, So what do you make of the financial cliff? Anything to worry about? Thanks, Alan In a real world with a real president and a real congress and senate; three bodies that put the people of the United States ahead of their political ideologies; I would tell you not to be overly alarmed. However....... We have a teleprompter as head of state, a Republican congress with several senior members who think going over the cliff would not be a bad idea, and some true idiots in a Democratically controlled senate who think they can regain congress by allowing the economy to go over the cliff and then blame it all on the Republicans. This is a truly disgusting set of circumstances, in my opinion. If all these taxes hit and nothing is done about it, the result would be a 2-4% loss in GDP and a virtual guarantee of recession....again. What would I do prior to an event like that? I'd go to cash or cash equivalents and be around to pick up the pieces when the economy hits rock bottom and then launch myself into an early retirement. Will it happen? Who knows. I put nothing past the clowns on both sides of the aisle. Some conventional wisdom says the government cannot possibly be that stupid. The more cynical say that we ain't seen nothing yet. I guess I would fall into the more cynical group at this point in time. What can we do about it? Well......you could turn a three-legged barstool upside down and park the teleprompter, the leader of congress and the leader of the senate on one leg each without benefit of lubricants and make them stay there until they worked something out. Problem is, they might just end up liking it. Practically Speaking..... I decided to re-up my subscription to my favorite financial guru for a second opinion should things look like they are going south again. Problem is, this financial guru was on the radio in 2008 commenting on the Lehman collapse and the freezing up of the financial markets......and he did nothing (Heck, even I wasn't that stupid ). Several years later he said with some pride that he chose to remain fully invested throughout the crisis. That said, it never hurts to have a second opinion. I wouldn't follow the doomsday crowd and I wouldn't follow those with the rose-colored glasses. I have set up a plan to do some orderly selling if my gut tells me that that is the right thing to do. I think a President Romney could put a lot of things right in short order and I think you could see a tremendous relief rally when the votes are counted and a well-worn teleprompter gets retired back to the 'burbs of Chicago. A rally could be short lived if the tax issue is not resolved. I would think another four years of the teleprompter would probably be the worst case scenario and the financial cliff would be practically assured. November will be an interesting month. |

|

THE PROPHET WATCH What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here Financial Analyst - NOT Soothsayer - NOT Bearer of Practical Financial Advice - Occasional Man's Worst Nightmare - Maybe...... Having to listen to annuity pitches interspersed with vitamin infomercials could be worse. Let's keep track of just how well this PITA's 'predictions' pan out for the rest of the year. |

| 2012 | Predicted | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Gold | $2,000.00 | 1736.7 | 1716.28 | 1671.9 | 1664.2 | 1616.9 | 1604.2 | 1613.8 | 1683.4 | 1771.1 |

1724.4 |

||

| Recession | 60% Chance | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | ||

| TIPS Current 5yr Yield | Home Run - Maybe | 0.95% | 0.90% | -.126% | .125% | -1.03% | -1.00% | -1.22 | -1.286 | -1.46 |

-1.49 |