Personal

Portfolio

|

Not

a bad month, all in all. Can't believe the returns on Fidelitie's GNMA.

Doing better than GE . Can't believe the returns on

Fidelity Growth and income either. 63.92% for a growth and income

fund?

Probably would have done a bit better if I hadn't taken

positions in HBAN, RF and MBI. I am regarding these as longer

term holds and am now a bit overweighted in this sector.

This

mix has been working quite well. I am thinking that when finance

normalizes, that will be rapidly be followed by commodities and then

manufacturing.

If the consumer doesn't end up getting clobbered by ObamaCare and Cap&Tax, we could even have something of a recovery.

|

|

The Year So Far

It looks like I'll be closing up somewhere over 50% for

the year and that is with an 11% position in fixed income so I am

pretty pleased with myself.

And then this comes along:

Just

because you have a lot of money, it doesn't necessarily mean you have a

lot of sense. I have zero sympathy for this crowd.

What do you think the odds are of a Teleprompter sponsored bailout?

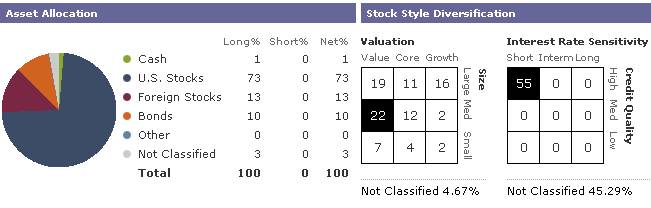

Morningstar's Instant X-Ray

Morningstar's

Instant X-Ray does a pretty good job of showing

you what you actually own vice what you think you own.

A couple things I'd point out here:

Cash at 1%:

This

of course means most of your money is working for you. What would

this mean if say the cash position was at 5%, excluding personal cash

reserves?

It would tell me that one or more mutual funds I own

are holding cash and that can be a good or bad thing depending on how

the fund is doing relative to its peers. If the fund is

under performing, holdings lots of cash and it is trailing its peers

then you might want to consider another fund. If the fund is

matching or beating its indexes and holding cash, odds are the

fund is going to invest that cash at an opportune time.

Interest Rate Sensitivity - Not Classified at 45.29%

I

would be looking into this if I didn't know what it was, and I do.

The culprit here is PGH, the Canadian Oil Trust. X-Ray

doesn't do a very good job at rating Foreign securities sometimes and I

am comfortable with this one. If I didn't know, I would be

for finding out in short order.

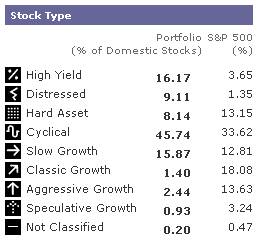

This

section is self explanatory. It looks at the make up or your

portfolio compared to the make up of the S&P 500 index.

Manufacturing

I

am considerably overweight in Manufacturing stocks as compared to this

index because I think the market is going to recover and this is one of

the sectors I think that has to recover first and has lots of

opportunity for adequate diversification.

Services

Next

is the services sector. I think the most room for profits going

forward is in Financial Services and it is the only one I am looking at

in this group at this time. My focus is on a couple large banks,

a couple regional banks and a bond insurer.

Health Care

services............wouldn't touch that with a 10' pole if it looks

like the Teleprompter and his liberal minions win the day.

Business and Consumer Services

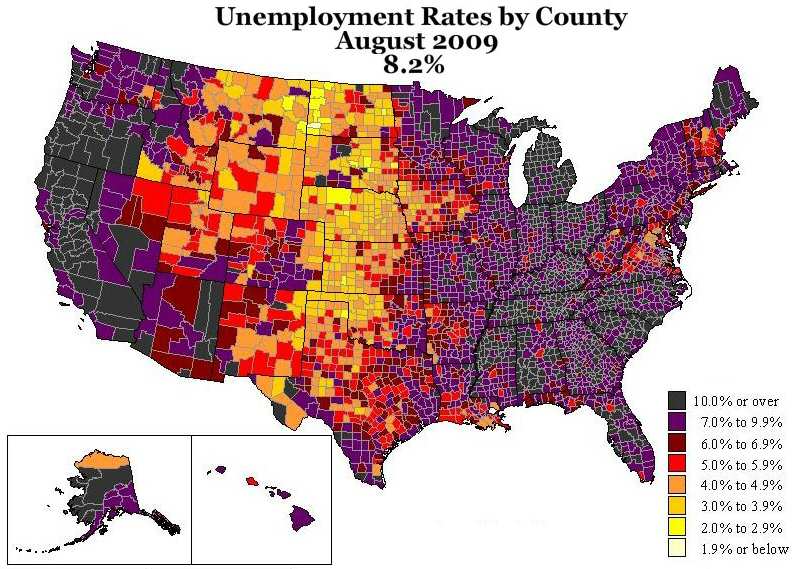

Not

interested while this recovery continues to be a jobless one. I'd

consider investing in this area when employers stop working their

existing employees more and more, and have to actually hire people to

fuel their expansion

Decent returns this year for not having much at all in speculative, aggressive or classic growth.

I think what powered the returns was having cyclical, extremely undervalued growth.

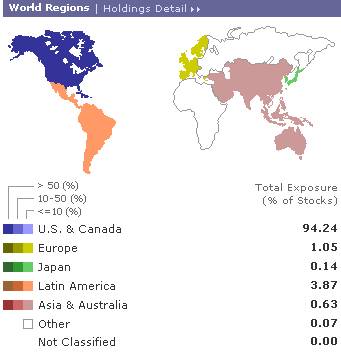

North

America is where I plan on being for the near future. I will

probably use a mutual fund or two, or maybe an ETF when it looks stable

enough to up the allocation in foreign stocks.

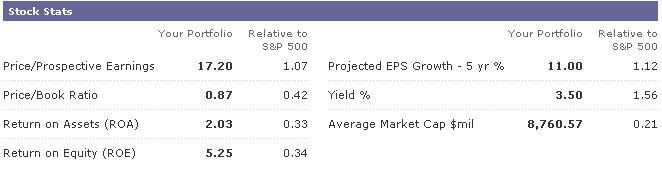

This looks pretty good, I think. I don't get the Average Market Cap figure at all. That looks totally out of whack.

The

traditional line of thinking in 'Normal Times' is that for adequate

diversification one should have no more than 4% in any one stock, which

would in theory spread the risk around to at least 25 stocks and that

makes sense to me.

However in these abnormal times, I believe

that rule should be waived for a while because it limits one's ability

to recover losses.

Case in point:

I originally bought a lot of Huntsman at two and change, and I mean a lot.

When the stock started moving, it moved fast. It rapidly became

10% of the portfolio and I got concerned about that so I sold about 3%.

It went on to become about 14% of the portfolio again in short order so I sold another 6-8%.

Then

I got to thinking about it....If you own stocks that you are believe

are of quality which got creamed during the sell-off, and you believe

the market was grossly oversold (which I did), why sell anything until

the market normalizes and with it, the share price?

If I keep

rebalancing to keep within normal allocations and I believe I have

cheap quality, am I not minimizing the possibility for outstanding

potential? I think I am.

The big question to me is:

"What is going to be the future normal and how do I price future normal?"

"How much of the pricing we've seen is the result of a credit driven economy. Sans credit, what is reality?

I think I will digress here a minute because that reminded me of something else:

We

used to walk our dogs a couple blocks west and up in the sandy hills

where we let the dogs loose to run to their hearts content.

Several

years ago the nearest hills turned into a high priced housing

development, minimum 500K to get your through the front door. This got

you a two story house on a landscaped acre looking down on the Carson

Valley and up at the Sierras. The highest priced homes came in

around 800k.

We ended up walking the dogs through this

development to get to the hills and in the course of doing so, met a

number of owners of these high priced, gorgeous homes.

Quite a

few of these people were in there mid 20's to early 30's. There were at

least two brand new vehicles in the driveway, most had a couple of

quads, some had boats and other toys. All of this was

new.

The guys looked like Northern Nevada styled Metrosexuals and the women had equally impressive wardrobes.

This

was one of the first major disconnects where what we were seeing didn't

make a lot of sense. Median income in our area is around 30-35K.

Multiply that X 2 and you get 70K for a couple. I know some

of these home buyers had incomes very close to that range.

My

wife and I don't exactly make chump change and we were at a loss to

explain how many of these people could possibly afford what was out

of our reach.......unless we made frivolous use of credit and cut down on saving and investing. It was

the topic of many conversations.

Quite a difference from 2-3 years ago and recently one went under 400k. Major haircuts here.

Two years after the bubble

burst, the high priced housing development is floundering. We looked at

several of these homes and talked to Realtors sitting outside these

homes in the summer heat with less than hopeful looks in their

eyes.

Turns out a number of these homes were financed

with interest-only loans and all the new toys these people had were

financed by taking a second or third or fourth on their home. The

logic was that it didn't matter because housing prices

would only go up.

I am sure the outcome of most of these questionable loans ended up in broken marriages, broken lives and broken dreams.

One

of the homes originally sold for $675K to a couple half my age.

That lasted until the first mortgage reset. Several months ago

the home was purchased in the low 4's as the result of a short sale.

The

new owners differ quite a bit from the buyers we were used to seeing in

the housing heyday. I would put them in their mid 40's, they have

a couple teenagers and they drive cars which have seen better days. I

see several mountain bikes in the garage and in terms of toys, that's

about it. I'll bet they put at least 20% down on the property as

well.

The above example is doubtlessly

taking place throughout the country and is being experienced by

thousands, or 10's of thousands, or 100's of thousands of home owners.

The only difference is in terms of degree.

The result of this is going to be one huge reset and we are in the middle of it right now.

I'll

bet the words Walmart and Target which were once anathema to

those living credit driven lifestyles are now the words of choice.

It

is a tough lesson to learn and it will stick for a while but being the

kind of people we are, there will always be another bubble further down

the road. Hopefully most of us will see it for what it is and not

get sucked into it.

Is that overly optimistic?

Yep

Now Where Was I?

"What is going to be the future normal and how do I price future normal?"

I am sure there are complex mathematical models and simulators for this kind of question.

Me, I prefer to keep things simple.

I

pulled up a 5 year price chart for Huntsman and used some precision

eyeballing to estimate a fair, median price for the stock. Looks

to me like $20.00 is a decent figure and if I am buying the stock under

$10.00, I am getting a bargain in share price and am collecting

dividends to boot.

There are other factors of course but I

think unless allocations get totally skewed to where risk becomes a

major consideration, the balance of shares are going to ride and

provide more shares in the form of dividends along the way.

Williams Companies I got for 14 and change.

After the Dot.Com bust, I was trading this in the 2's. Should have held on to it.

I

figure this is worth somewhere around $30.00 a share in normal times so

I have the possibility of a 100% gain on this stock + more shares in

the form of dividends in the interim.

If you make use if this

rather crude methodology and employ some prudence, and take the longer

term perspective you could end up sitting on a gold mine.

Closing Comments

If

one looks around for quality stocks trading well below their 5 year

average, there are still quite a few floating around.

The financial institutions

to me are the big question mark.

Take Bank of America for example:

This

stock I bought in the 3's, chickened out and sold in the 7's, and then

ended up buying at 9, sold some again because I chickened out again,

and then bought more in the 10-14 dollar range to hold for the duration.

Now

in the midst of this financial fiasco BofA made at least two

acquisitions, Merrill Lynch and Countrywide. One of them I think was

forced on BofA.

Look a year or three down the road as the

economy recovers and the excesses are drained from the housing market.

Let's say the credit markets return to normal as well.

Bank of

America will probably be the largest home mortgage provider in the

country and it will have a nice investment arm to boot.

What

might a reasonable value for BofA? I'd say a conservative

$40.00, a speculative return to the $60.00's and possibly quite a bit

higher if its two acquisitions once again become profitable members of

society.

Extend that thought to some of the other

under performing banks still hanging in there and a few other stocks

from other under- performing sectors.....

Dare I think 'Early Retirement?'

It's fun to dream.

Denver

can be one or the more problematic airports during winter.

The original flight out of Denver got canceled. 10 hours

later, I finally got on board and spent another 1/2 hour or so not

moving because the plane's wheels were stuck to the ground - ice.

Once the wheels got unstuck there was another half hour wait to

get de-iced, courtesy of the machines on the right. Not a lot of

fun.

|

|