| December 31, 2012 'A dollar picked up in the road is more satisfaction to us than the 99 which we had to work for, and the money won at Faro or in the stock market snuggles into our hearts in the same way.' ~Mark Twain |

|

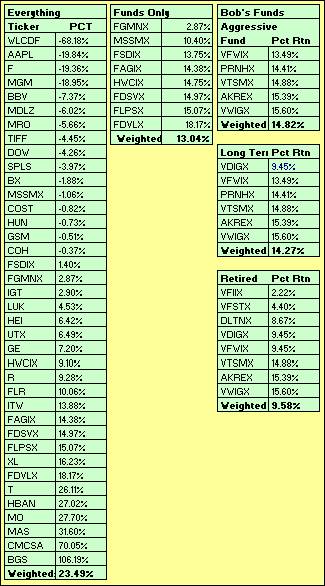

The Professional Opinion - DJ 13104.14 Bob is still concerned that we have not had a significant pullback. He remains at a heightened vigilance about valuations.  Buy Recommendations None. Everything is rated as a hold, as is usually the case.  First Snow of the Season! |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |  I think 2012 ended up with the US government from the teleprompter on down, winning the title of most inept administration in history, especially as it pertains to finance. What kind of civilized government cannot get its act together enough to let citizens and businesses alike know what their tax rates are going to be for the 2013 so they can do a little planning. In this department we are a pathetic example of leadership....and how much do we pay these clowns?  |

| 2012 Year-End Observations 2012 was a year for trading - trading on rumor, hype and knee-jerk reactions. It was also filled with opportunities to pick up quality companies at attractive prices. My aim throughout the year was to increase the overall quality of the portfolio and with that, its value. I think I did a pretty good job there. REIT's had worked well for me for years but several months ago it was time to bail before the stock prices got hit too hard. I am unsure what was causing that but will be reading Annaly's quarterly opinion piece which will likely address the issue.

Banking was reduced to 5% of the portfolio with holdings in just one stock - Huntington Bancshares. With our government's 'eat the rich' mentality, I think that is the prudent thing to do. HBAN is a strong Midwestern regional bank and one that will do just fine if left alone. Investing companies were also reduced to one, that being Blackstone (BX). The company has been making a lot of purchases in real estate in particular, and continues putting its money to work over time. Manufacturing stocks were taken to 20%, which should be a good place to be as housing continues to improve. Great prices on some of these stocks. Telecom continues to remain at around 10% and I think with the speed at which Telecom is evolving, a significant weighting will produce significant results. Comcast and ATT continue to work well for me. Tech on the other hand is not something I am good at evaluating and if I was really interested in it, I would probably use a mutual fund or ETF as the investment vehicle of choice. For 2013, I think a slow and faltering recovery is underway and it will to remain slow and faltering recovery until the government gets out of the way and unfortunately for us home gamers, I don't see that happening anytime soon. I do think that we may end up seeing some significant upside as government guaranteed bond yields stay in the toilet, finding quality in muni's is becoming more challenging and risk in junk bonds becomes more....well....risky. At some point I think there will be an inflection and money will start moving back into equities, if solely for the yield. Could work out rather well for those whose focus is primarily on equities. And...It's also time to do a reality check:   Morningstar's Instant X-Ray is a good way to give you a snapshot of what is truly in your portfolio in order to double-check the weightings. I usually do this once a year. Based on where the economy is, this looks reasonable to me. About those Special Dividends Special dividends and any dividend distributions for that matter: Say company X has a share value of $100.00 a share, you have 1 share and it announces that it is going to do a one-time special distribution of $10.00 a share on X-Date. What happens is when the stock goes ex-dividend is the stock pays out $10.00 and the stock price drops by the same amount - to $90.00. In this case if you are reinvesting the dividends, you now have about 1.1 shares at $90.00 a share. In other words, you are still at par. You still have the same amount of money but at a diluted number of shares. But >>>>>>>>>>>>>>>>>> If you sell your share at $100.00, holding holding it long enough to get the special dividend....and then be on line in your account when the ex-dividend payout date occurs, you buy back your shares of company X at $90.00 a share and that gets you an extra .1 shares on that trade alone. Plus >>>>>>>>>>>>>>>> That $10.00 a share you got in distributions? That buys another .1 shares at $90.00, so now your have 0.2 extra shares, or 1.2 shares as compared to your original single share. So >>>>>>>>>>>>>>> You are in effect doubling your dividend payout in the form in new shares and it is entirely legal. And, if you are holding these in tax exempt accounts - you just made a nice chunk of change. It hinges on being online and watching for the distribution to hit. It's usually close to first thing in the morning, EST. Another added bonus- - generally speaking, the stock will tend to rise somewhere back to its original value post distribution if you are in a rising market. Having a quality company whose prospects are good enhances the probability that the stock price will continue to rise. It's a great way to salt away extra money with relatively little work. However >>>>>>>>>>>>> Strange things can happen and one of those strange things is the value of the stock can be decreased by the dividend amount before it goes ex-dividend. I'd never seen that before but apparently it can be done on NYSE traded stocks. For that reason if you buy something to collect the dividend, consider whether or not it was something you might not mind keeping for longer than you wished. |

|

THE PROPHET WATCH - YEAR-END RESULTS What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here Financial Analyst - NOT Soothsayer - NOT Bearer of Practical Financial Advice - Occasional Man's Worst Nightmare - Maybe...... Having to listen to annuity pitches interspersed with vitamin infomercials could be worse. |

| 2012 | Predicted | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Gold | $2,000.00 | 1736.7 | 1716.28 | 1671.9 | 1664.2 | 1616.9 | 1604.2 | 1613.8 | 1683.4 | 1771.1 |

1724.4 |

1719.0 |

1675.8 |

| Recession | 60% Chance | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! | Nope! |

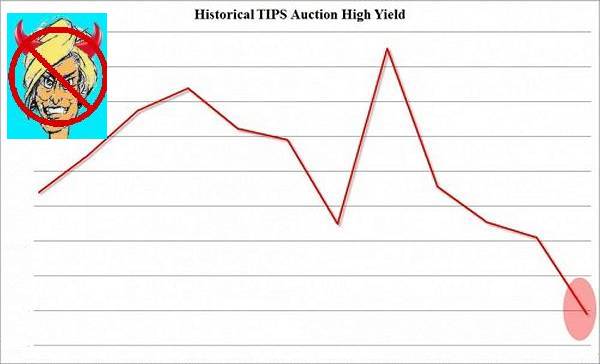

| TIPS Current 5yr Yield | Home Run - Maybe | 0.95% | 0.90% | -.126% | .125% | -1.03% | -1.00% | -1.22 | -1.286 | -1.46 |

-1.49 |

-1.40 |

-1.34 |